Verdict:

• Short-run Neutral.

Macro:

• On May 23rd, the China National Development and Reform Commission, the Central Bank, and other four departments mentioned promoting stable and moderate reductions in loan interest rates, optimizing tax and fee preferential policies, implementing structural tax reduction and fee reduction policies and strengthening scientific and technological innovation. Appropriately reduce import tariffs on advanced technology equipment and resource commodities.

• European Central Bank President Lagarde said that due to the trend of rapid consumer price growth, interest rates may become lowered in next month. The market currently expected three times of interest cut in 2024.

Iron Ore Key Indicators:

• There was no seaborne trade as the absence of index yesterday. Iron ore corrected in this morning session following the significant drop on silver and copper, down 6.6% and 6.8% respectively in two trading days.

SGX Iron Ore 62% Futures& Options Open Interest (May 22nd)

• Futures 122,369,600 tons(Increase 2,345,100 tons)

• Options 122,369,600 tons(Decrease 22,149,600 tons)

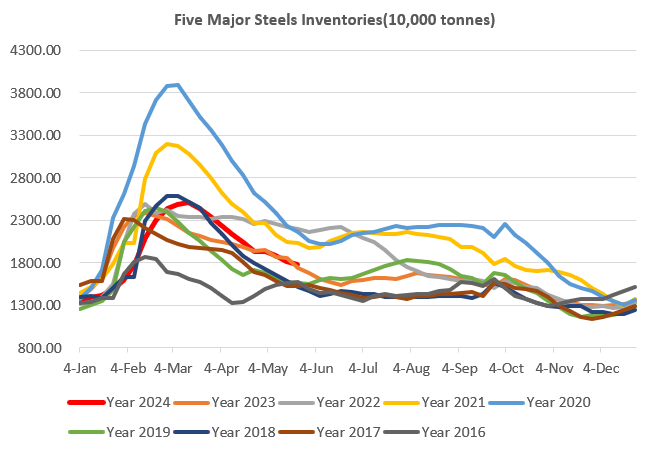

Steel Key Indicators:

• Tangshan average billet cost 3481 yuan/ton, up 14 yuan/ton, average gains at 79 yuan/ton, up 96 yuan/ton.

• According to CRU, crude steel production reached 155.7 million tons in April, down 5% on the year.

Coal Indicators:

• Atlantic met coal export price lower under pressure from sluggish demand and a surplus on spot cargoes.