Verdict:

• Short-run Neutral.

Macro:

• US initial jobless claims was 215,000 last week, down 8,000 from previous week, created the biggest single week decrease of the year.

• European Central Bank President Lagarde said that due to the trend of rapid consumer price growth, interest rates may become lowered in next month. The market currently expected three times of interest cut in 2024.

Iron Ore Key Indicators:

• Platts62 $119.50, -1.20, MTD $117.43. China mills started to indicate concerns on the sustainability of iron ore growth in coming June, because a weaker steel demand coupled with higher supply. China iron ore port inventories reached 14.855 million tons, which created year-high and seasonal high.

SGX Iron Ore 62% Futures& Options Open Interest (May 23rd)

• Futures 125,690,700 tons(Increase 3,321,100 tons)

• Options 177,170,700 tons(Increase 54,801,100 tons)

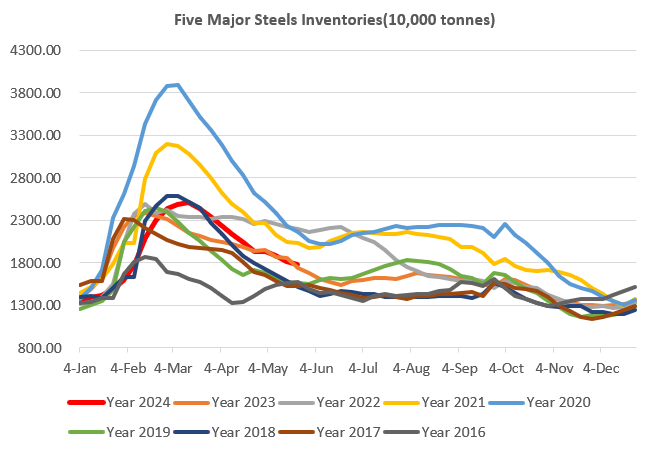

Steel Key Indicators:

• CISA statistic indicated that mid-May China membership steel mills produced 22.09 million tons of crude steel, up 0.81% on the week, down 1.61% on the year.

Coal Indicators:

• After the difference from buyers and sellers for several trading days, PMV finally traded at $235/mt.

• As the weakening trend on China physical coke market, buyers became cautious on showing bids.