Verdict:

• Short-run Neutral.

Macro:

• In May, consumer confidence in the US unexpectedly rebounded after three consecutive months of deterioration, with the Consumer Confidence Index rising from an upward revised 97.5 in April to 102.0 this month. Previously, a Reuters survey predicts that the index will drop from the previously reported 97.0 to 95.9. According to a report released by the FHFA, housing prices rose 6.7% year-on-year in March, following a 7.1% increase in February.

• According to Reuters, Saudi Arab potentially price of oil delivered to Asia in July, which created the first drop over the past five months.

Iron Ore Key Indicators:

•Platts62 $117.85, -1.15, MTD $117.71. Rio Tinto’s exports from Port Dampier and Cape Lambert rose by 3.09% week on week to 6.01 million mt. The weekly average shipments were at 5.94 million mt over the previous four weeks. BHP’s shipments from Port Hedland totaled 5.8 million mt, an increase of 7.77% week on week. Over the four previous weeks, its average volumes were 5.36 million mt. Vale’s exports from Brazilian ports soared by 65.54% week on week to 6.98 million mt. Over the four previous weeks, average volumes were 5.23 million mt. FMG’s volumes from Port Hedland reached 4.08 million mt, an increase of 5.15% week on week. Weekly average shipments totaled 3.86 million mt over the previous four weeks. Roy Hill’s shipments rose by 35.92% to 1.33 million mt. Exports from Saldanha Port in South Africa were flat on week at 1.05 million mt.

SGX Iron Ore 62% Futures& Options Open Interest (May 28th)

• Futures 133,131,200 tons(Increase 1,694,900 tons)

• Options 183,067,300 tons(Increase 1,101,100 tons)

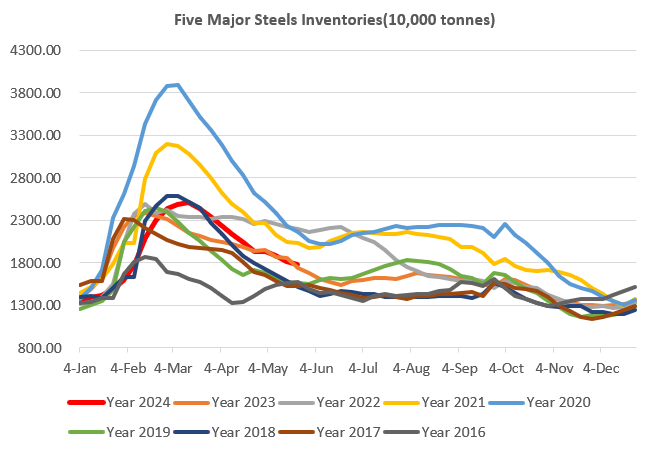

Steel Key Indicators:

• MySteel estimated a 2.37-2.38 million tons of pig iron production in June on daily basis, however the real number should be lower as the marginal decrease on pig iron usage and higher scrap usage.

Coal Indicators:

• China daily coke concentration at ports at 17,000 tons/day, down 4,000 tons/day.