A total of 1.885 million mt of iron ore was exchanged hands for the week ended Sep 4, an increase of 52.37% as compared to the 1.237 million mt recorded last week. Medium grade fines like Pilbara Blend fines (PBF) accounted over half of the transacted trades for this week at 57%, as compared to …

Author archives: Titus Zheng Shujian

Capesize rates fall on thin demand base

Capesize freight rates continued to tumble down in the oversupplied market, while both basins posted lower fixtures throughout the week. The Capesize 5 time charter average then dropped by $890 day-on-day to $16,748 on Thursday, due to long liquidation in the market. The Baltic Dry Index (BDI) then dropped further by 3.46% or 50 points …

DCE pullbacks amid steel demand recovery

Iron ore futures closed on negative region on Friday, after much rally throughout the week. The most-traded iron ore for January 2021 delivery on China’s Dalian Commodity Exchange suffered a pullback, dipping 1.45% or RMB 12.50 day-on-day to RMB 850 per tonne on Friday. Similarly, the steel rebar contract on the Shanghai Futures Exchange faced …

Capesize rates lower on thin shipping activities

Capesize freight rates continued its correction phrases on thin market activities, especially among ship-operators. Thus, the Capesize 5 time charter average went down by $406 day-on-day to $17,638 on Wednesday, following a selloff that reduced spot premium. The Baltic Dry Index (BDI) then fell by 1.77% or 26 points day-on-day to 1,445 readings from weaker …

Continue reading “Capesize rates lower on thin shipping activities”

DCE inches up amid stable mills’ stocks

Iron ore futures continued to rise throughout the week on good steel demand from China amid peak construction season. The most-traded iron ore for January 2021 delivery on China’s Dalian Commodity Exchange rose slightly by 0.88% or RMB 7.50 day-on-day to RMB 857.50 per tonne on Thursday. Likewise, the steel rebar contract on the Shanghai …

Capesize rates slip despite decent shipping demand

Capesize freight rates entered correction phrase despite decent shipping demand and high iron ore prices in the market. Thus, the Capesize 5 time charter average saw a slight correction of $350 day-on-day to $18,044 on Tuesday, after an aggressive selloff down the forward curve. The Baltic Dry Index (BDI) then fell by 1.14% or 17 …

Continue reading “Capesize rates slip despite decent shipping demand”

DCE rallies on peak steel season

Iron ore futures maintained the bullish run on better steel demand from China due to peak construction activities season during the Sep-Oct period. The most-traded iron ore for January 2021 delivery on China’s Dalian Commodity Exchange rose by 1.06% or RMB 9 day-on-day to RMB 854.50 per tonne on Wednesday. However, the steel rebar contract …

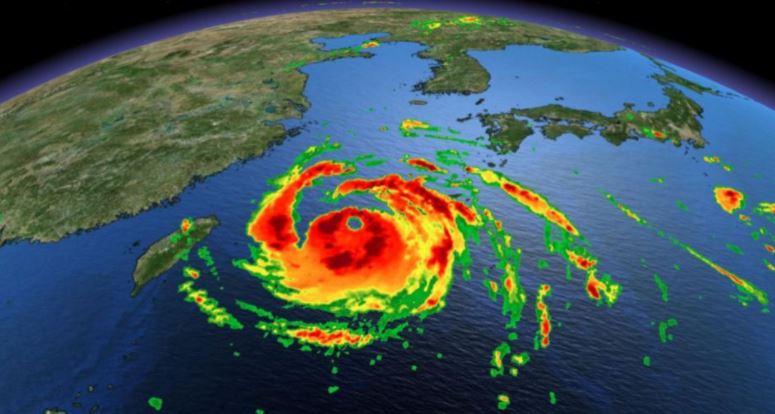

Capesize rates firm over potential shipping disruption

Capesize freight rates started to strengthen for the week with market concerns over port congestion in China, typhoon threats in the Far East and high iron ore prices. However, the firmer rates may reverse at any instance after the typhoon left with little shipping disruption to the East Asia region. In view of this weakness, …

Continue reading “Capesize rates firm over potential shipping disruption”

DCE inches up on fastest PMI growth

Iron ore futures continued to rally for the second consecutive days on good economic indicators and robust steel demand. The most-traded iron ore for January 2021 delivery on China’s Dalian Commodity Exchange rose slightly by 0.24% or RMB 2 day-on-day to RMB 846.50 per tonne on Tuesday. The steel rebar contract on the Shanghai Futures …

DCE rallies from strong steel demand and positive PMI

Iron ore futures started the week on higher note due to strong Chinese steel demand and positive economic indicator. The most-traded iron ore for January 2021 delivery on China’s Dalian Commodity Exchange rose by 2.61% or RMB 21.50 day-on-day to RMB 844 per tonne on Monday. The steel rebar contract on the Shanghai Futures Exchange …

Continue reading “DCE rallies from strong steel demand and positive PMI”