Please click below to view the report For more information please contact FIS info@freightinvestor.com London +44 (0) 207 090 1120 Singapore +65 6535 5189 Dubai + 971 4 449 3900 Shanghai: +86 21 6335 4002 US (CT): +1 203 325 8004 US …

Category archives: News

Supramax & Handysize FFA Daily Report

Please click below to view the report For more information please contact FIS info@freightinvestor.com London +44 (0) 207 090 1120 Singapore +65 6535 5189 Dubai + 971 4 449 3900 Shanghai: +86 21 6335 4002 US (CT): +1 203 325 8004 US …

Capesize & Panamax FFA Daily Report

Please click below to view the report For more information please contact FIS info@freightinvestor.com London +44 (0) 207 090 1120 Singapore +65 6535 5189 Dubai + 971 4 449 3900 Shanghai: +86 21 6335 4002 US (CT): +1 203 325 8004 US …

Fuel Oil Daily Evening Report

Please click below to view the report For more information please contact FIS info@freightinvestor.com London +44 (0) 207 090 1120 Singapore +65 6535 5189 Dubai + 971 4 449 3900 Shanghai: +86 21 6335 4002 US (CT): +1 203 325 8004 US …

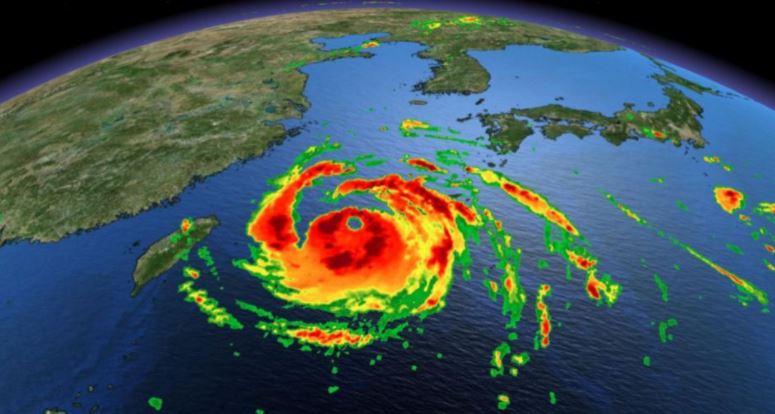

Capesize rates firm over potential shipping disruption

Capesize freight rates started to strengthen for the week with market concerns over port congestion in China, typhoon threats in the Far East and high iron ore prices. However, the firmer rates may reverse at any instance after the typhoon left with little shipping disruption to the East Asia region. In view of this weakness, …

Continue reading “Capesize rates firm over potential shipping disruption”

Oil Through the Looking Glass 1/9/20

*Storm Damages Continue to hamper U.S. Gulf of Mexico Energy Operations* As refiners look to restart offshore operations, onshore repairs that are necessary as a result of the hurricane damages have been hampered this week due to power outages in Louisiana where the storm made early landfall on Thursday. Offshore production in the region was …

Steel & Scrap Morning Report 1/9/20

Please click below to view the report For more information please contact FIS info@freightinvestor.com London +44 (0) 207 090 1120 Singapore +65 6535 5189 Dubai + 971 4 449 3900 Shanghai: +86 21 6335 4002 US (CT): +1 203 325 8004 US (KS): +1 813 490 6630

DCE inches up on fastest PMI growth

Iron ore futures continued to rally for the second consecutive days on good economic indicators and robust steel demand. The most-traded iron ore for January 2021 delivery on China’s Dalian Commodity Exchange rose slightly by 0.24% or RMB 2 day-on-day to RMB 846.50 per tonne on Tuesday. The steel rebar contract on the Shanghai Futures …

Fertilizer Financial Markets Commentary/Curves

Please click below to view the report For more information please contact FIS info@freightinvestor.com London +44 (0) 207 090 1120 Singapore +65 6535 5189 Dubai + 971 4 449 3900 Shanghai: +86 21 6335 4002 US (CT): +1 203 325 8004 US (KS): +1 813 490 6630

Morning Oil Report 1/9/20

Brent futures climbed 49 cents, or 1.1%, to $45.77 a barrel at 4:06 am GMT, while WTI futures rose 37 cents, or 0.9%, to $42.98 a barrel. The current weakness in the dollar in the wake of the U.S. Federal Reserve’s policy shift on inflation announced last week is expected to push the currency …