Category archives: News

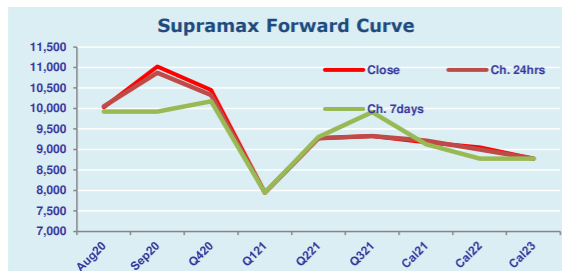

Supramax & Handysize FFA Daily Report

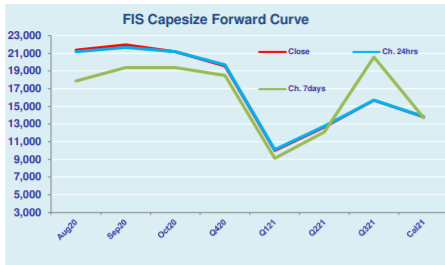

Capesize & Panamax FFA Daily Report

FIS LONDON COKING COAL MARKET REPORT

Fuel Oil Daily Evening Report

Monthly Fuel Oil Report

Capesize rates rally over congestion in the Pacific

Capesize rates started the week on bullish note as bad weather, crew replacement and stricter quarantine measures affected the tonnage supply. The Capesize 5 time charter average hiked up by $755 day-on-day to $19,051 on Monday, as market participants expected freight rates recovery over short term. Due to the improvement in Capesize, the Baltic Dry …

Continue reading “Capesize rates rally over congestion in the Pacific”

Is the US election campaign damaging to US agricultural trade?

attempted to rebalance the east-west balance in recent years. However if the current administration lacks the economic argument it needs to win votes, then perhaps it has decided that it is time to flex its international muscle to convince American voters it is still the best party to lead them into a trade war. US …

Continue reading “Is the US election campaign damaging to US agricultural trade?”

Oil Through the Looking Glass 4/8/20

*China Only Fulfilled 5% of Promised US Energy Purchases Under the terms of the China-US trade deal agreed last year China agreed to purchase some $25.3 billion worth of American oil products. Halfway through 2020 and they have only completed 5% of that target as the relationship between the two countries sours. China imported only …

DCE rallies again over supply concerns

Iron ore futures continued to rally for second consecutive day since the start of week over supply concerns. The most-traded iron ore for September delivery on China’s Dalian Commodity Exchange went up by 3.31% or RMB 28.50 day-on-day to RMB 890 per tonne on Tuesday. The steel rebar contract on the Shanghai Futures Exchange then …