Category archives: News

Fertilizer Financial Markets Commentary/Curves

London Iron Ore Market Report

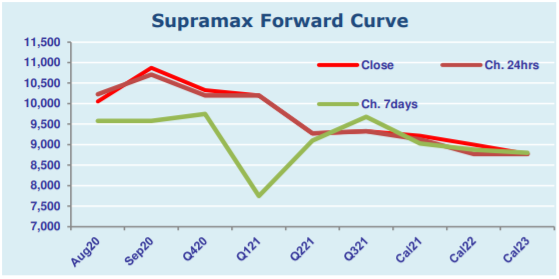

Supramax & Handysize FFA Daily Report

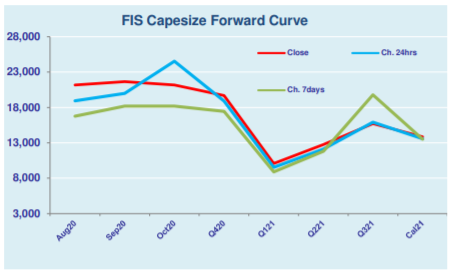

Capesize & Panamax FFA Daily Report

FIS LONDON COKING COAL MARKET REPORT

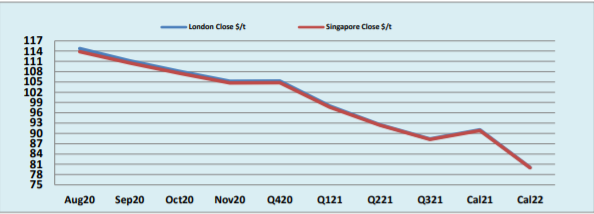

Fuel Oil Daily Evening Report

Oil Through the Looking Glass 3/8/20

*Asian Fuel Oil Market News It is expected that the strong sentiment in the physical is to continue for VLSFO with lower arbitrage cargoes coming into Singapore. Imports for August are estimated to be 1.5 – 2 million tonnes, down from 2 – 2.5 million tonnes in July. This is also being driven by lower …