Category archives: News

Capesize & Panamax FFA Daily Report

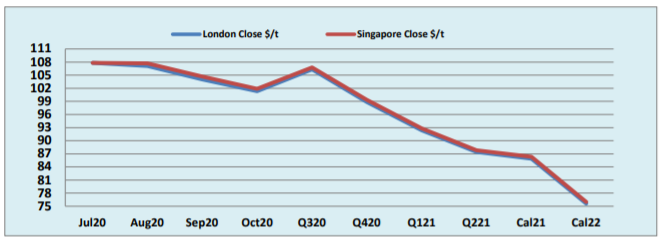

Fuel Oil Daily Evening Report

Oil Through the Looking Glass 30/7/20

*Biggest US Crude Draw Since 2019 The EIA reported a 10.6 million bbl drop in crude stocks, however the total stocks were still 17% above the 5-year seasonal average. Crude oil: -10.6M Gasoline: +0.7M Distillates: +0.5M Refinery utilisation: 79.5% *BP Fined for Shetland Oil Spill BP has been fined £7,000 after spilling 95 tonnes of …

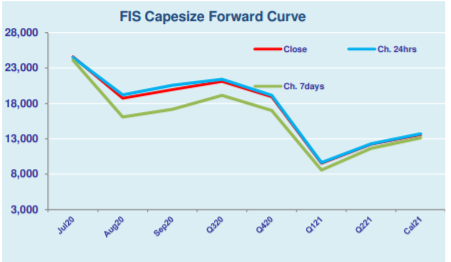

Capesize rates rebound on firm Pacific market

Capesize rates jumped on better physical market with both basins seemed significant gains despite an upcoming public holiday in Singapore. The Capesize 5 time charter average hiked up by $1,197 day-on-day to $17,721 on Wednesday, with Aug and Sep contracts traded on highs of $19,250 and $20,750 respectively. With improvement in Capesize, the Baltic Dry …

Continue reading “Capesize rates rebound on firm Pacific market”

DCE surges on accelerated bond completion by end-Oct

Iron ore futures rose further upon news of special bonds issuance to be completed by end-October, according to the China’s Ministry of Finance. Thus, the most-traded iron ore for September delivery on China’s Dalian Commodity Exchange went up by 1.02% or RMB 8.50 day-on-day to RMB 840 per tonne on Thursday. The steel rebar contract …

Continue reading “DCE surges on accelerated bond completion by end-Oct”