Category archives: News

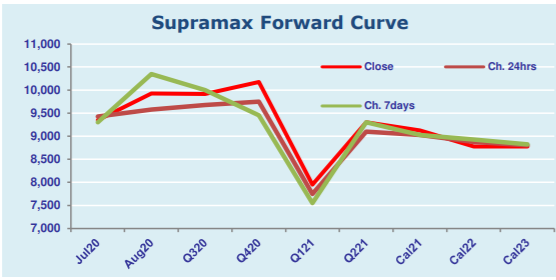

Supramax & Handysize FFA Daily Report

London Iron Ore Market Report

FIS LONDON COKING COAL MARKET REPORT

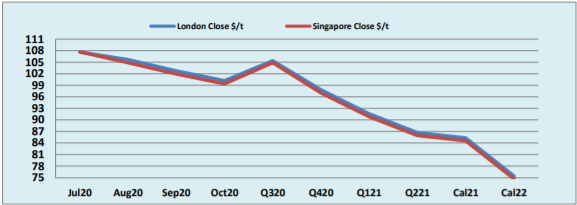

Fuel Oil Daily Evening Report

DCE Iron Ore

Oil Through the Looking Glass 28/7/20

*Brace for the Second Wave As the British Prime Minister, Boris Johnson, warns the country to start to prepare for a second wave of the virus after implementing quarantine measures on visitors from mainland Spain, so too the oil industry is warning of yet more disruption to come. Top US and European oil companies are …

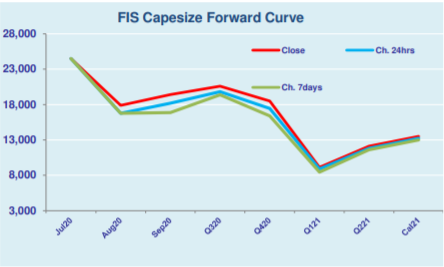

Capesize rates correct further on bearish outlook

Capesize rates resumed its correction phrases for the short week with Singapore on public holiday at Friday. The Capesize 5 time charter average then dropped further by $270 day-on-day to $17,014 on Monday, after a sluggish start of the short trading week. Likewise, the Baltic Dry Index (BDI) slipped 1.82% day-on-day to 1,293 readings on …

Continue reading “Capesize rates correct further on bearish outlook”

DCE dips on the close after high opening

Iron ore futures dipped slightly toward the close, after opening high in morning session on better market outlook on infrastructure sectors. Thus, the most-traded iron ore for September delivery on China’s Dalian Commodity Exchange dipped slightly by 0.12% or RMB 1 day-on-day to RMB 820 per tonne on Tuesday. Likewise, the steel rebar contract on …