Category archives: News

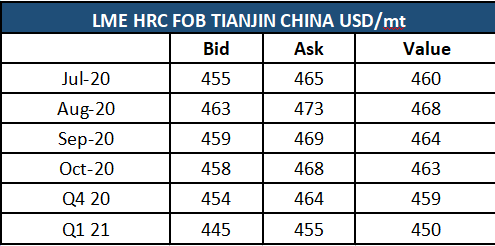

DCE corrects on narrowing steel margins

Iron ore future saw a slight correction and retreated from the recent rally due to narrowing steel margins. Thus, the most-traded iron ore for September delivery on China’s Dalian Commodity Exchange slipped slightly by 0.29% or RMB 2.50 to RMB 845.50 per tonne on Thursday. On the contrary, the steel rebar contract on the Shanghai …

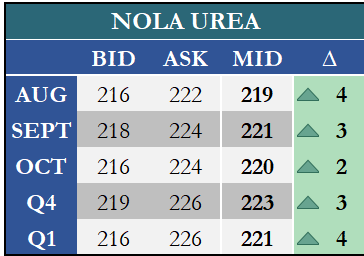

Fertilizer Financial Markets Commentary/Curves

London Iron Ore Market Report

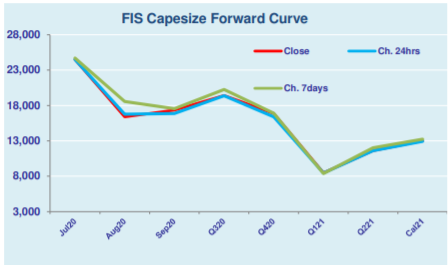

Capesize & Panamax FFA Daily Report

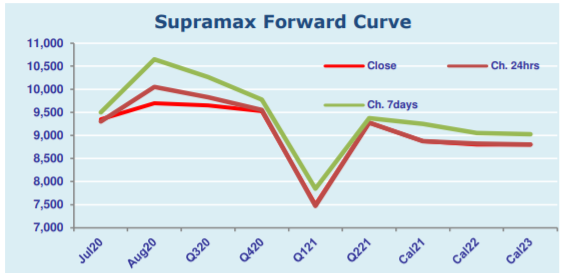

Supramax & Handysize FFA Daily Report

FIS LONDON COKING COAL MARKET REPORT

Fuel Oil Daily Evening Report

FIS Castaway Podcast Episode 17

Nervous you don’t know enough about Air Freight Futures? Surely you can’t be serious…. Tune in to this week’s episode of FIS Castaway to learn more on AFFAs, and get the usual commodity market analysis from the FIS team. Available now on the FIS website (www.freightinvestorservices.com/media ) Spotify https://open.spotify.com/show/7yMLsm5s8tLtrCQr7bG8wD?si=FW6Rvj9HRjClAx3vRjq8iw And Apple https://podcasts.apple.com/sg/podcast/fis-castaway/id1507094242 Disclaimer: freightinvestorservices.com/castaway-disclaimer/

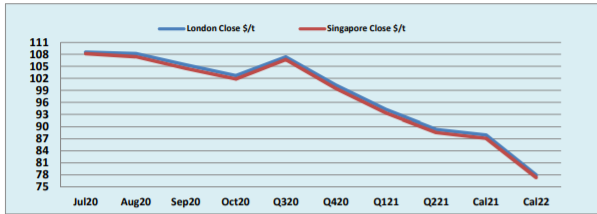

FIS Singapore Iron Ore Derivatives Report 22/07/2020

Iron ore futures slumped on Wednesday morning in London on fresh concerns over rising US-China tensions after US forced the closure of the Chinese Consulate at Houston. Iron ore futures initially held firm, with Aug hovering around mid-108 despite China’s Ministry of Industry and Information Technology warned on Tuesday that current iron ore prices …

Continue reading “FIS Singapore Iron Ore Derivatives Report 22/07/2020”