Iron ore futures continued its correction phrase as buyers found prices too high amid mixed market sentiments. The most-traded iron ore for September delivery on China’s Dalian Commodity Exchange dropped by 0.42% or RMB 3.50 day-on-day to RMB 826 a tonne on Friday. However, the steel rebar contract on the Shanghai Futures Exchange gained slightly …

Category archives: News

Ship Shape – FIS Commodity Weekly 17/07/20

A V-Shaped Recovery We have noted for several weeks now that there are more and more examples of countries or sectors returning to work. GDP figures show China has returned to growth, with many other countries reversing the dramatic trend that befell their Q1 economic data. It is, so far, a V-shaped rebound that has …

Continue reading “Ship Shape – FIS Commodity Weekly 17/07/20”

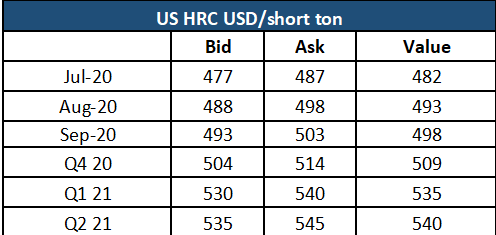

Steel & Scrap Morning Report

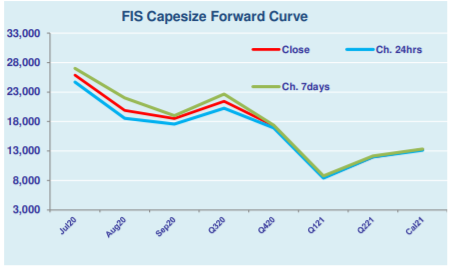

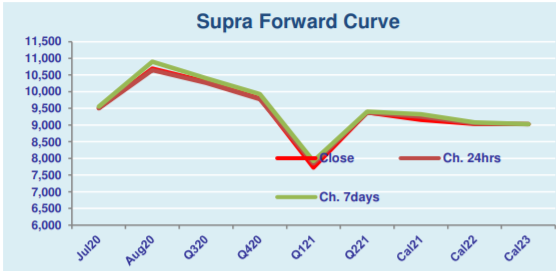

ShipShape: A V-Shaped Recovery

We have noted for several weeks now that there are more and more examples of countries or sectors returning to work. GDP figures show China has returned to growth, with many other countries reversing the dramatic trend that befell their Q1 economic data. It is, so far, a V-shaped rebound that has mirrored much of …

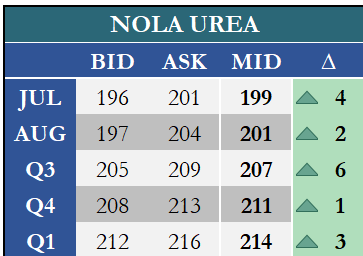

Fertilizer Financial Markets Commentary/Curves

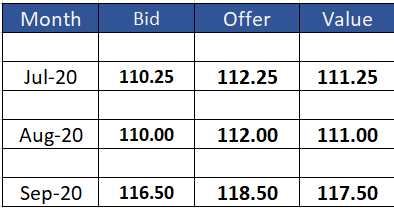

FIS LONDON COKING COAL MARKET REPORT

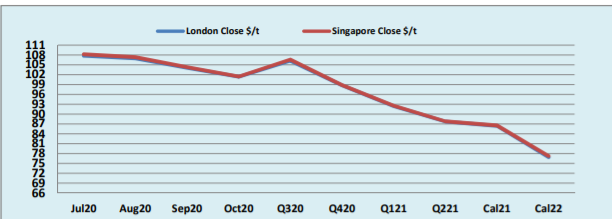

London Iron Ore Market Report

Capesize & Panamax FFA Daily Report

Supramax & Handysize FFA Daily Report

China stocks slide sparks iron ore sell-off

Iron ore futures saw losses on the back of the biggest fall of Chinese stocks in more than five months, as investors cooled down their buying spree on signs of policy tightening after the country’s economic growth in the second quarter beat expectations. This, coupled with some profit-taking activities on the back of the …

Continue reading “China stocks slide sparks iron ore sell-off”