*OPEC Eases Oil Cuts OPEC+ Joint Ministerial Monitoring Committee agreed on July 15 to taper production cuts from the current 9.7 million b/d to 7.7 million b/d from August. The main motivation behind this decision was confidence about recovering global demand, aided by seasonal consumption in many OPEC countries in the Middle East where peak …

Category archives: News

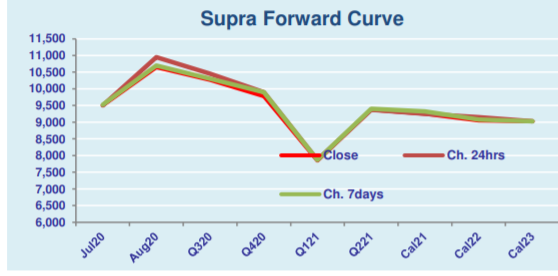

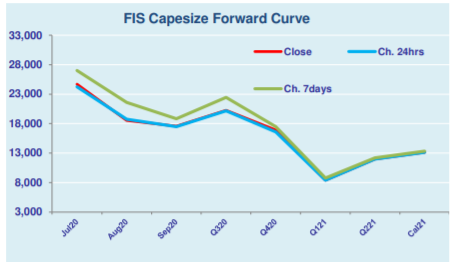

Capesize rates venture into a week of correction

Capesize rates came under correction again, perhaps fulfilling market expectation of a week for correction due to shipping supply glut. The Capesize 5 time charter average then fell further by $1,175 day-on-day to $24,387 by mid-July, 15 July 2020, despite an influx buyers entered at the afternoon session. Following the decline, the Baltic Dry Index …

Continue reading “Capesize rates venture into a week of correction”

DCE corrects amid mixed outlooks

Iron ore futures slipped slightly on Thursday, for correction after the recent rally amid mixed market outlook. The most-traded iron ore for September delivery on China’s Dalian Commodity Exchange dipped by 0.84% or RMB 7/mt day-on-day to RMB 826.50 a tonne. Likewise, the steel rebar contract on the Shanghai Futures Exchange also dropped by RMB …

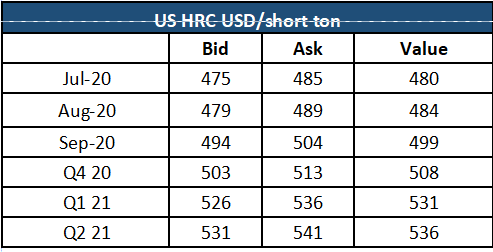

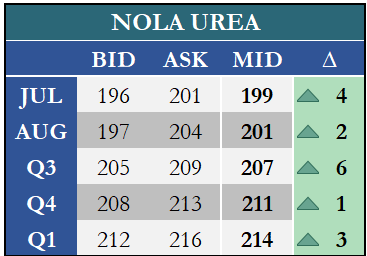

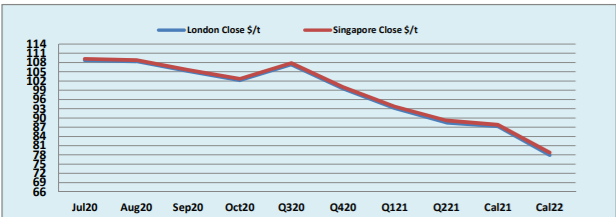

Steel & Scrap Morning Report

OPEC+ to ease cuts on improving market confidence

According to data released yesterday by the EIA, US crude inventories fell 7.5 million barrels to 531.7 million barrels for the week ended July 10, outpacing the 2.1 million-barrel drop expected by analysts and narrowing the surplus to the five-year average to 16.6%. Furthermore, gasoline stocks fell 3.1 million barrels over the same period to …

Continue reading “OPEC+ to ease cuts on improving market confidence”