Category archives: News

FOMO drives China iron ore sentiment

Iron ore futures rallied sharply on the first trading day of the week on market optimism over steel demand as China’s recovery gathered momentum. An upturn in industrial output suggests that the economy expanded in last quarter after cratering in the opening three months due to the coronavirus impact, according to Bloomberg Economics. The robust …

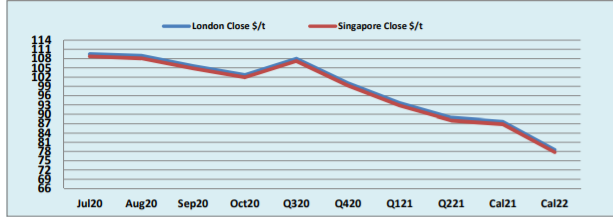

*Oil Through the Looking Glass 13/7/20*

*The Easing of OPEC’s Cuts?* With returning demand OPEC could start to loosen its production cuts after its recent move at strict adherence to the agreement. Saudi Arabia, who had previously been the main driver behind getting absolute compliance with the cut agreement from all participants, apparently is now pushing to an easing of the …

Capesize rates correct on muted market activity

Capesize rates dropped on limited market activity as some trade participants were away due to public holiday in Singapore. The Capesize 5 time charter average dipped by $437 day-on-day to $27,644 on Friday, as the paper market was muted and rangebound due to the Singapore holiday. Due to the quiet market, the Baltic Dry Index …

Continue reading “Capesize rates correct on muted market activity”

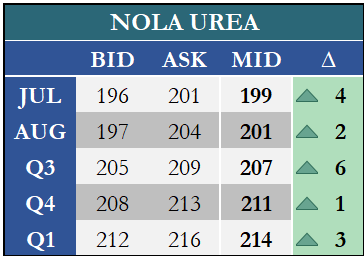

Fertilizer Financial Markets Commentary/Curves

DCE continues to rally from last week gains

Chinese futures ended the afternoon session on gains and continued the rally seen last week in view of market optimism and possible supply tightness from Brazilian suppliers. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, rose by RMB 38 or 4.80% day-on-day to RMB 829 per tonne on …

Continue reading “DCE continues to rally from last week gains”

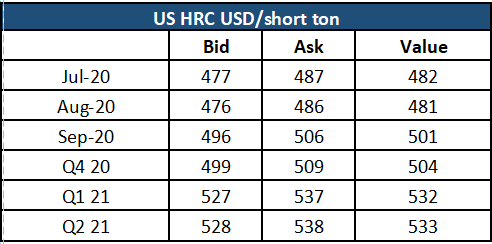

Steel & Scrap 13-07-20

Oil and Ore Intraday Morning Technical

OPEC+ ponders when and how far to cut

OPEC’s Joint Ministerial Monitoring Committee (JMMC) will meet on Tuesday and Wednesday to recommend the next level of cuts after compliance in the group hit 107% in June, up from 77% in May. Record high inventories in the US and a second wave contagion around the globe have added speculation that OPEC+ might yet …