Category archives: News

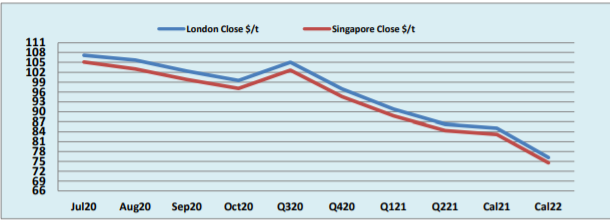

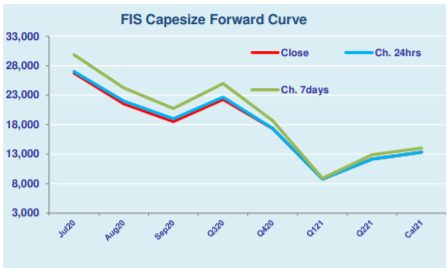

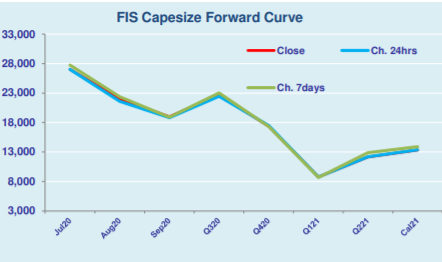

Capesize & Panamax FFA Daily Report

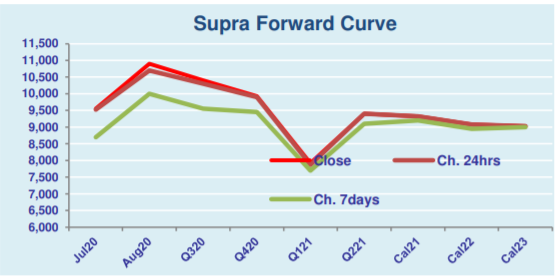

Supramax & Handysize FFA Daily Report

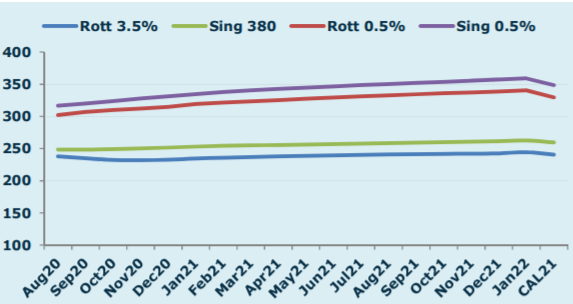

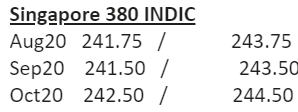

Fuel Oil Daily Evening Report

Oil Through the Looking Glass 10/7/20

*Singapore Holiday Adds to Quiet Friday* Singapore was on holiday today due to a snap election which left the market without its usual morning trading window and therefore volumes were diminished. Oil continued on from losses yesterday after the announcement of the Supreme Court decision in the release of President Trump’s finances. The market looks …

Oil and Ore Intraday Morning Technical

Crash, Bang, Recovery

It was never going to be easy recovering from the largest economic shock the world has ever encountered. After record drop in consumer spending, GDP, travel and so many other indicators, it is hard to quite fathom the scale of the disruption, or the mountain left the climb to bring things back to normal. Debt …

Morning Oil Note 10/7/20

Good morning all. Brent crude fell by 25 cents, or 0.6%, at $42.10 a barrel by 3:41 am GMT. WTI was down 33 cents, or 0.8%, at $39.29. Brent seems to be set for a weekly fall of nearly 2%, while US crude for a drop of more than 3%. Daily COVID-19 infections in US, …