Category archives: News

Fuel Oil Daily Evening Report

Globally bullish or a bullish bubble?

It started in China. Base metals, equities and now iron ore have caught the bull market bug that started five days ago on the Shanghai Composite Index. The index was up nearly 6% from the close on Friday, capping five days of gains that has seen a 12.5% increase in the last five sessions. Optimism …

Capesize’s bull run continues, driven by tight tonnage and weather delays

Capesize market continued its bullish run with rates hovering above the $30,000 level in view of the tight tonnage supply in both basins. Thus, the Capesize 5 time charter average rose by $1,305 day-on-day to $32,682 on Friday, while the Baltic Dry Index (BDI) reached new high at 1,894 points, up 3.89% day-on-day. Crewing issue …

Continue reading “Capesize’s bull run continues, driven by tight tonnage and weather delays”

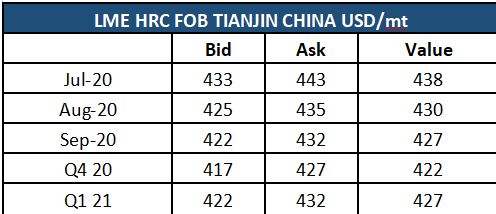

Steel & Scrap 06-07-20

DCE ends high on market optimism

Chinese futures rose on the opening day of the week, due to bullish market sentiment and concerns over supply tightness. As such, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, rose by RMB 6.50 or 0.87% day-on-day to RMB 750.50 per tonne on Monday. Similarly, the steel rebar …

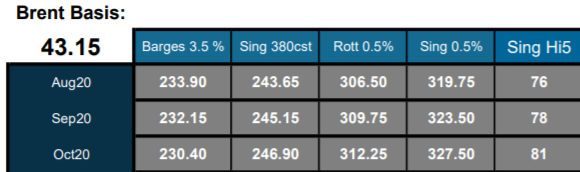

Short term crude direction waits on data

Newly reported coronavirus cases and mobility data, including an EIA report on gasoline consumption coming out later this week, will be watched by market participants in order to determine the short-term direction of crude prices in the next few days. On the supply side OPEC+ production is at its lowest since 1991 and is …

Paralos joins the FIS podcast this week

A heads-up that special guest Demetris Polemis, Portfolio Manager of the Paralos Fund joins the FIS podcast this week. Demetris and the FIS team will discuss the increasing financialization of the freight and iron ore markets, evidenced by the emergence of systematic funds, data-driven decision-making and non-traditional market participants. Available on Wednesday 8th July on …

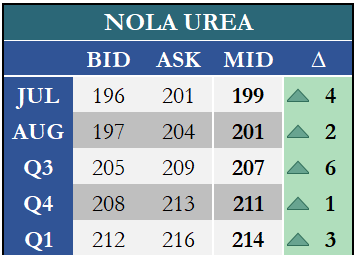

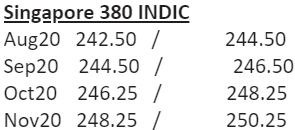

Fertilizer Financial Markets Commentary/Curves

Morning Oil Note 6/7/20

Oil futures were mixed on Monday morning, with Brent buoyed by tighter supplies to 18 cents (0.4%) at $42.98 a barrel at 2:52 am GMT, while concerns about rising COVID-19 cases in the US dampened WTI futures by 23 cents (0.6%) to $40.42 from its last settlement on Thursday. Newly reported coronavirus cases and mobility …