Oil futures rose this morning after lower than expected crude inventories in the United States, and despite an increase in coronavirus cases lightly obfuscating a positive demand outlook. At 3.45 am GMT front-month Brent futures were up 48 cents (1.2%), to $41.75 a barrel. WTI was up 54 cents (1.4%), at $39.81 a barrel. According …

Category archives: News

DCE moves flattish amid high PMIs

Chinese futures remained almost flat for Wednesday, till a selldown in the afternoon session that led to a negative closing. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, went down slightly by RMB 2.00 or 0.27% day-on-day at RMB 742 per tonne on Wednesday. Similarly, the steel rebar …

Fuel Oil Daily Evening Report

FIS LONDON COKING COAL MARKET REPORT

London Iron Ore Market Report

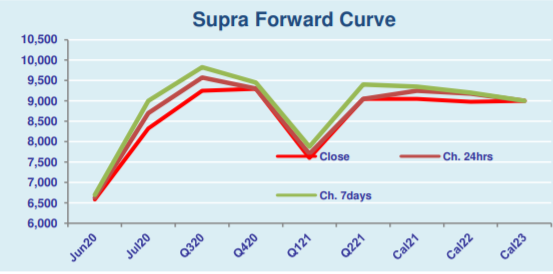

Supramax & Handysize FFA Daily Report

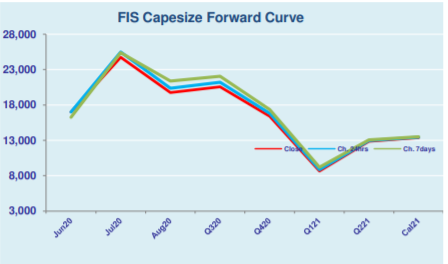

Capesize & Panamax FFA Daily Report

Oil Through the Looking Glass 30/6/20

*HSFO – The Comeback Kid* When the IMO 2020 regulation came into effect at the start of the year, people had previously predicted that the old grade HSFO would be in oversupply and collapse in price. What has actually come about is a story of great strength and versatility of the old grade fuel. HSFO …

Iron ore uneasy over China weather, steel demand

Iron ore futures rebounded modestly on Tuesday as investors remained concerned over China’s steel demand. Rebar led the way for the rebound in Asia as investors became concerned over the latest environmental curbs in Tangshan which may lead to temporarily closure of many blast furnaces and sintered machines in the area. Iron ore failed …

Continue reading “Iron ore uneasy over China weather, steel demand”