This week the group discuss supply and demand in crude, freight, iron ore, and copper markets. We explore the reasons behind the freight markets jump, oil’s crawl upwards, and iron ore’s price stall, among other market news and trends. https://freightinvestorservices.com/blog/fis-castaway-eps-12-unprecedented-coverage-in-unprecedented-times/

Category archives: Coking Coal

FIS Capesize Technical Report

FIS Capesize Technical Report On the last report we noted that if the RSI went through the 62—64 resistance level the index had a greater chance of going on a run. This has been the case with the index moving 100% higher. To view the full report please click on the link

Iron ore futures fall as China steel demand slows, virus cases rise

Iron ore futures fell sharply on Monday on concerns over China’s recovery. Data released on Monday showed China churned out a record of 92.27 million tonnes of steel. According to SteelHome data, iron ore port inventories fell to 107.75 million tonnes last week, the lowest since October 2016. While the decline in port inventories …

Continue reading “Iron ore futures fall as China steel demand slows, virus cases rise”

Iron ore softer as pundits exchange views on supply outlook

Iron ore futures were a touch softer on Wednesday as investors assessed the supply outlook for iron ore following the recent closure of Vale’s Itabria complex. Investors grew concerned over tight supply after Vale was ordered to shut down Itabria, which accounts for over 10% of Vale’s output, in the state of Minas Gerais …

Continue reading “Iron ore softer as pundits exchange views on supply outlook”

China steel imports boom, exports dip, iron ore softer

Iron ore futures were a touch softer on Tuesday as investors assessed outlook for iron ore. China imported 1.25 million mt of finished steel in May, up 27.2% month-on-month or up 30.3% year-on-year, according to customs data. During the same period, China’s finished steel exports fell by 30.4% month-on-month or 23.4% to 4.4 million …

Continue reading “China steel imports boom, exports dip, iron ore softer”

Iron ore blips back but rally ‘looks stretched’

Iron ore futures in Singapore recovered from yesterday’s blip and is set to finish the week on a high. The iron ore market has seen great volatility of late, pushing towards $100 on supply concerns following disruptions in Brazil as well as strong demand from China. Global steel demand is expected to fall …

Continue reading “Iron ore blips back but rally ‘looks stretched’”

Iron ore futures fall as players take profits

Iron ore futures slumped on Thursday following some profit-taking activities as market participants turned cautious. The iron ore market has seen great volatility, pushing towards $100 on supply concerns following disruptions in Brazil as well as strong demand from China. The Dalian Exchange issued a notice earlier this week, urging member brokerages to …

Continue reading “Iron ore futures fall as players take profits”

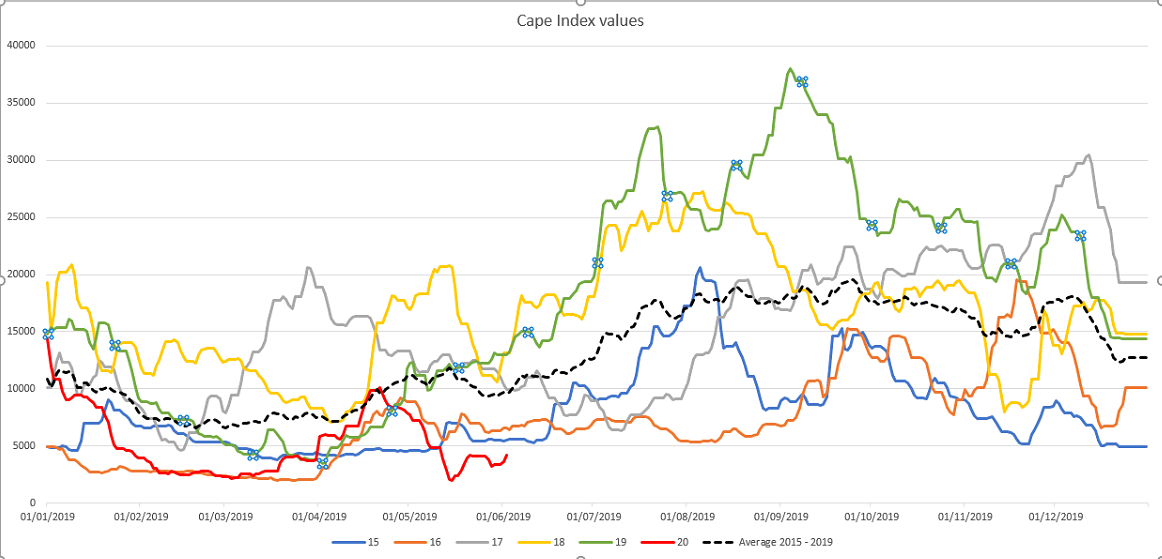

Capesize – Even Poor Summers give some Sunshine

2020 is taking the phrase annus horribilis to a new level for the Capesize 5tc market. The big sisters rarely have anything to celebrate in the first few months of the year, like a tourist spot emerging from lockdown, owners know that they to make hay when the sun is shining. Index values …

Continue reading “Capesize – Even Poor Summers give some Sunshine”

Iron ore keeps up top table pressure

Iron ore futures advanced on Wednesday as investors gauged over short-term iron ore supply. On one hand, Australian miners have been going flat out and the country may be shipping in record volumes. According to initial tally compiled by Bloomberg, shipments from Australia were up by 3.2 million tonnes in May year-on-year to 79.7 …

Iron ore consolidation points to potential reversal

Ferrous Sector Money-flow: DCE iron ore aggregated open interest reached a high at 1.18 million lots on February 21 as well as creating periodic high, following a correction of 19.26%. The open interest high last week was 1.15 million lots. Long positions need to be aware of the similar correction happen for the second time …

Continue reading “Iron ore consolidation points to potential reversal”