*Could There be Another Storage Boom* As the independent teapot refineries in the Chinese Shandong region increase their run rate, storage is once again reaching its limit. This greater run rate, is in attempt to de-congest the multiple VLCC’s waiting to discharge in Chinese waters. Demand for refined product is slowly starting to come online, …

Category archives: Freight

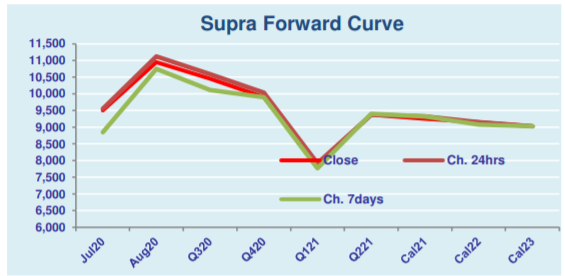

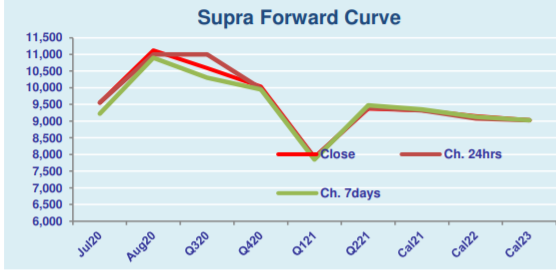

Supramax & Handysize FFA Daily Report

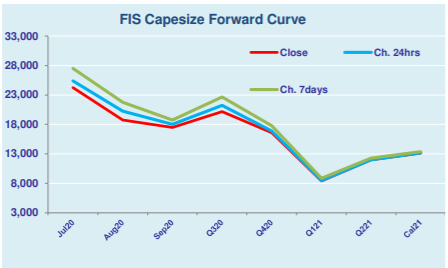

Capesize & Panamax FFA Daily Report

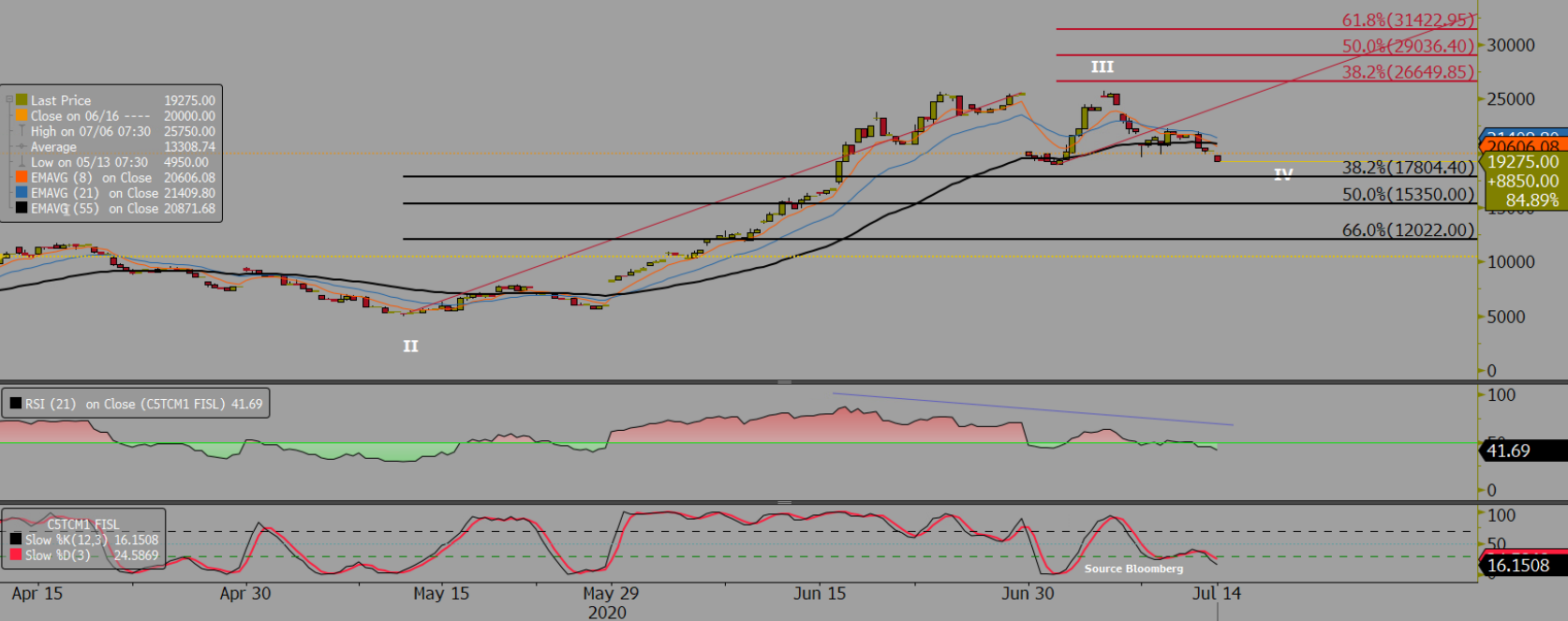

FIS Capesize Technical Report

Iron ore futures firmer as Australian volumes surge

Iron ore futures advanced on Tuesday on renewed optimism over a swift economic recovery in China and hopes for further demand after the rainy season. The world’s biggest steel producer brought in 101.68 million tonnes of iron ore last month, surging from 87.03 million tonnes in May, data from the General Administration of Customs …

Continue reading “Iron ore futures firmer as Australian volumes surge”

Freight Intraday Morning Technical

FIS Weekly Ferrous: iron ore neutral but risk remains

Ferrous Sector Money-flow: The previous weekly report gave seven weeks of short-run consolidation from the end of May when seeing the open interest peak for DCE market. However market was strong by the first half of July. Open interest indicated most of the push was due to exit of shorts and re-entry as new …

Continue reading “FIS Weekly Ferrous: iron ore neutral but risk remains”

Capesize rates slip on thin physical activity

Capesize rates slipped again over market concerns on the deteriorating physical market with long tonnage list in the Pacific market. On that note, the Capesize 5 time charter average dipped by $680 day-on-day to $26,964 on Monday, as the paper market came under pressure on declining physical market. Following the decline, the Baltic Dry Index …

Continue reading “Capesize rates slip on thin physical activity”

After flaming June, dry July for oil market?

Rising COVID-19 cases globally reached 13 million infections and half million deaths, remaining a key drag on market sentiments. With California, the Philippines, Hong Kong and Australia tightening restrictions again as daily infections spike, July could be an even more challenging month for oil than expected. Moreover, the market will be monitoring closely the …

Continue reading “After flaming June, dry July for oil market?”