Category archives: Freight

Crash, Bang, Recovery

It was never going to be easy recovering from the largest economic shock the world has ever encountered. After record drop in consumer spending, GDP, travel and so many other indicators, it is hard to quite fathom the scale of the disruption, or the mountain left the climb to bring things back to normal. …

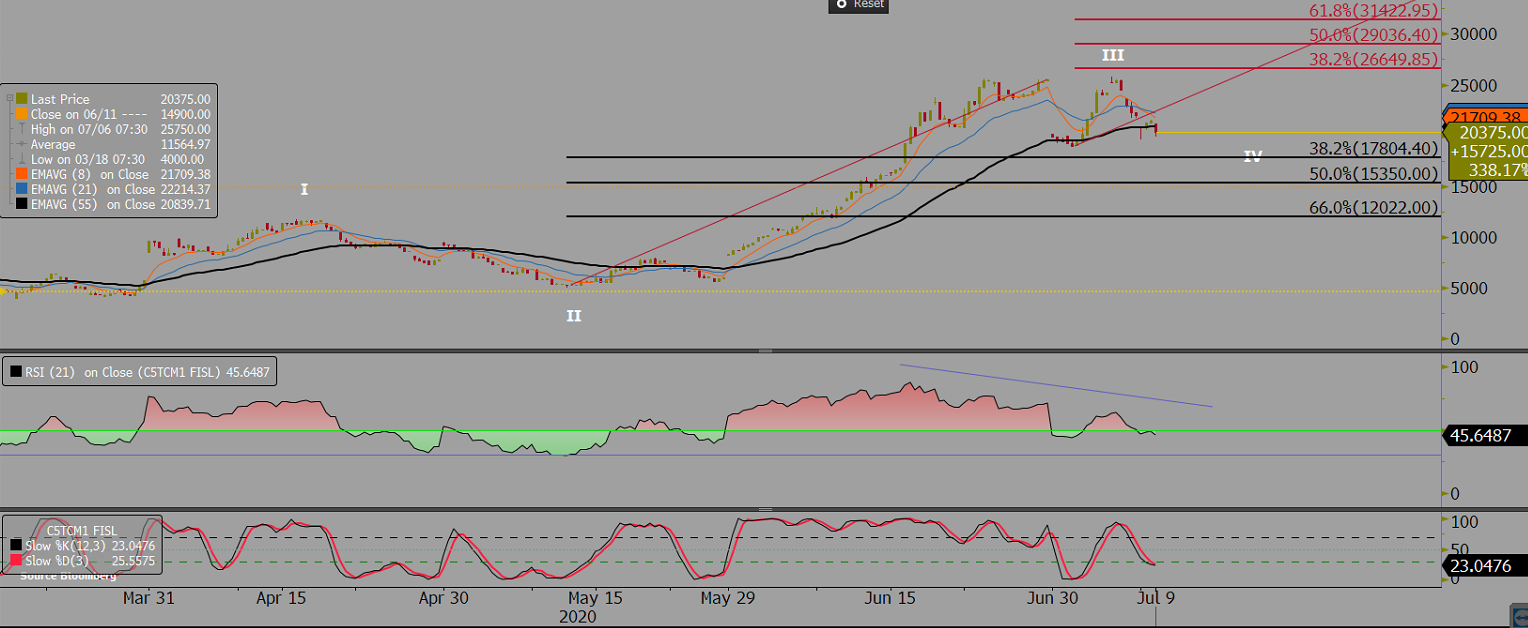

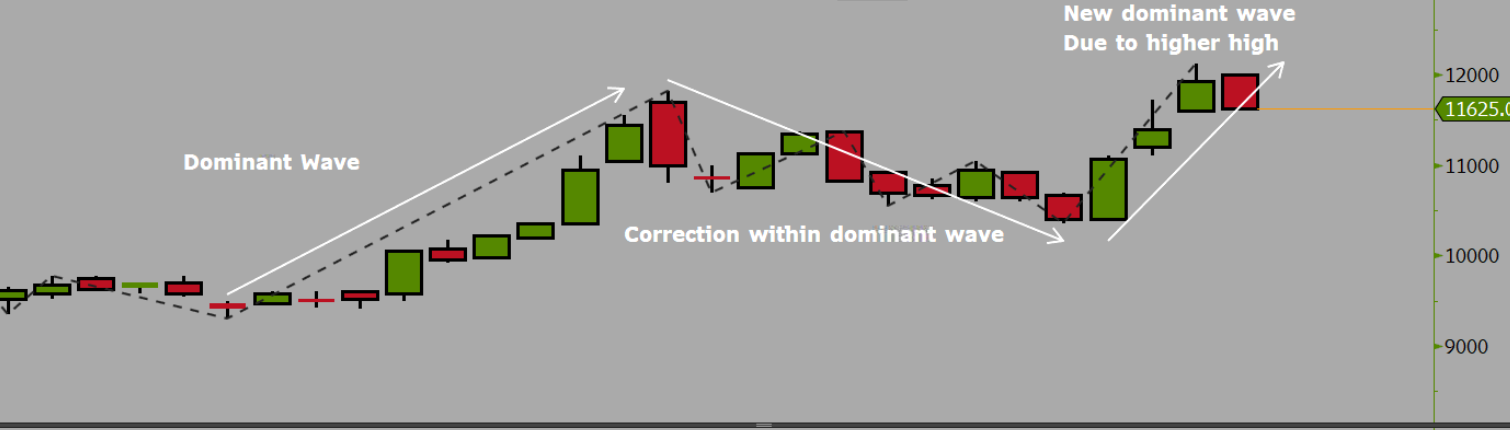

Freight Intraday Morning Technical

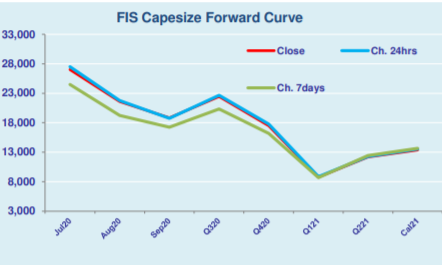

Capesize rates under correction after extended losses

Capesize rates came under pressure and took a correction with losses on both the Pacific and Atlantic basins. The Capesize 5 time charter average dropped by massive $3,301 day-on-day to $29,610 on Wednesday, with a large chunk of the recent gains wiped out in a single session. Following the plunge, the Baltic Dry Index (BDI) …

Continue reading “Capesize rates under correction after extended losses”

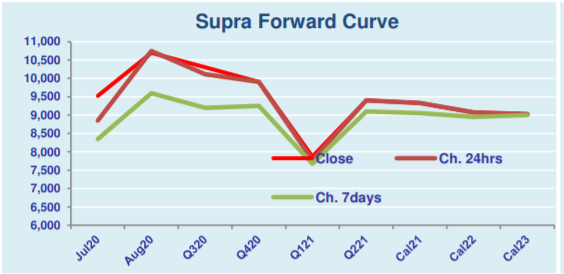

Supramax & Handysize FFA Daily Report

Capesize & Panamax FFA Daily Report

FIS Technical – Copper Rolling 3 Month

Tanker News Update 8/7/20

*Catastrophic Crack Margins* COVID-19 may have caused a tremor in the refining industry that will be seen for years to come. Simple refinery economics means profit is made in the differences on input (crude) and outputs (refined distillates). With global demand in refined products slumping in recent months their demand still isn’t growing enough to …