Category archives: Freight

Capesize & Panamax FFA Daily Report

Capesize rallies further on tighter tonnage

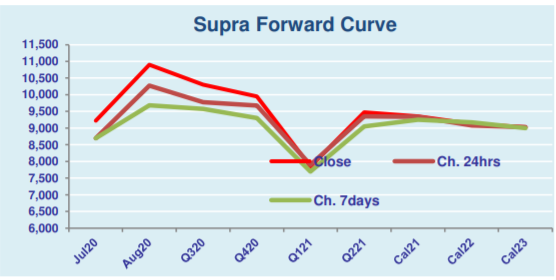

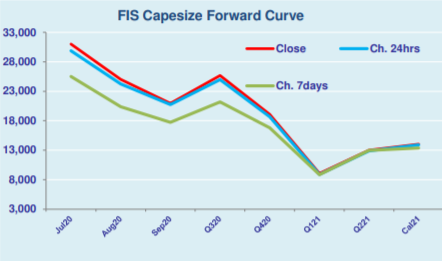

Capesize rates rallied further without any signs of slowdown as the rates chased for new height for the year. Thus, the Capesize 5 time charter average surged by $1,078 day-on-day to $33,760 on Monday, with the curve trending up to highs for July, August, Sept and Q3 contracts. Following the Capesize rally, the Baltic Dry …

Continue reading “Capesize rallies further on tighter tonnage”

FIS Weekly Ferrous Report – profit takers loom as iron ore holds at high level

Ferrous Sector Money Flow: DCE iron ore saw significant money flow in the market and rebounded after a few weeks of consolidation. However during the Asian morning Tuesday iron ore stuck in an RMB 5-7 range again. DCE iron ore index created a gold cross on Monday near-oversold area. The high of the September contract …

Continue reading “FIS Weekly Ferrous Report – profit takers loom as iron ore holds at high level”

Freight Intraday Morning Technical

Supramax & Handysize FFA Daily Report

Capesize & Panamax FFA Daily Report

Pmx v SMX Q4 20 – One to watch

Capesize’s bull run continues, driven by tight tonnage and weather delays

Capesize market continued its bullish run with rates hovering above the $30,000 level in view of the tight tonnage supply in both basins. Thus, the Capesize 5 time charter average rose by $1,305 day-on-day to $32,682 on Friday, while the Baltic Dry Index (BDI) reached new high at 1,894 points, up 3.89% day-on-day. Crewing issue …

Continue reading “Capesize’s bull run continues, driven by tight tonnage and weather delays”