Category archives: Freight

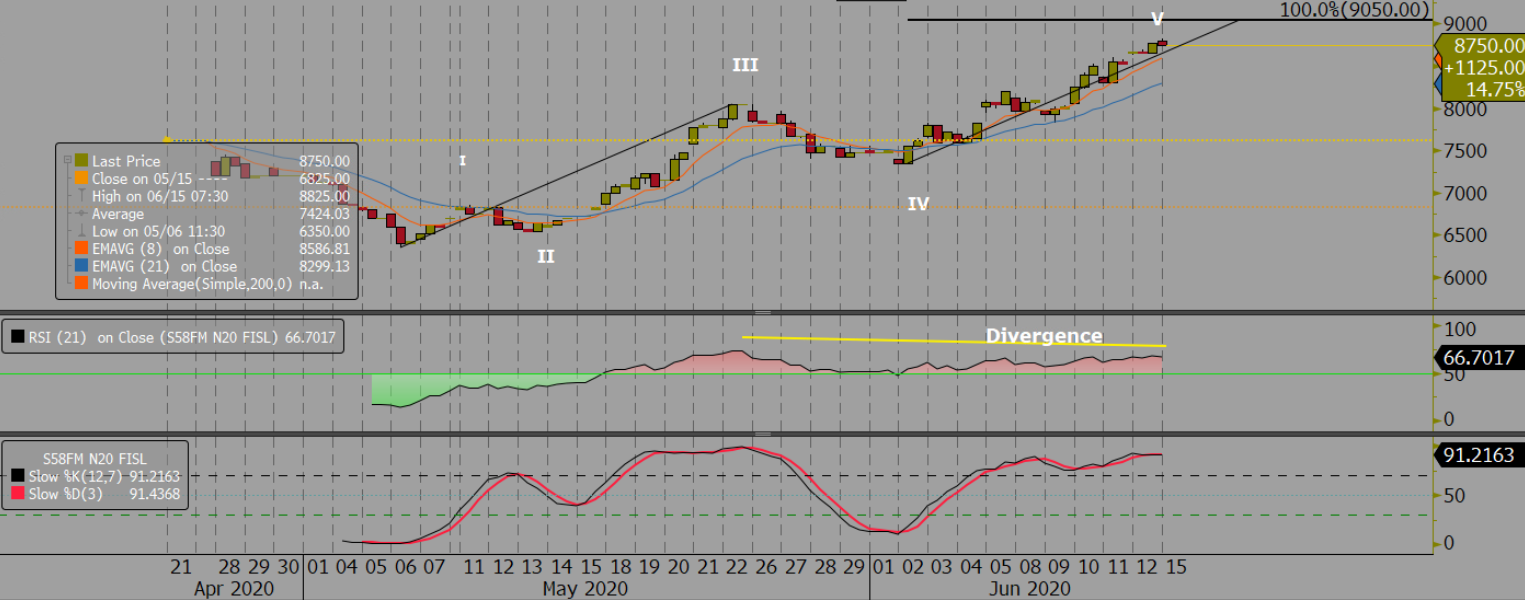

Capesize July 20 Morning Technical Comment – 240 Min

Capesize rates firm up in both basins

Capesize rates continued to rally as shipping demand improved in both the Pacific and Atlantic basins. Therefore, the Capesize 5 time charter average increased by $1,734 day-on-day to $12,410 on Friday, after strong afternoon session that pushed out of the tight trading seen in the morning session. This prompted the Baltic Dry Index to push …

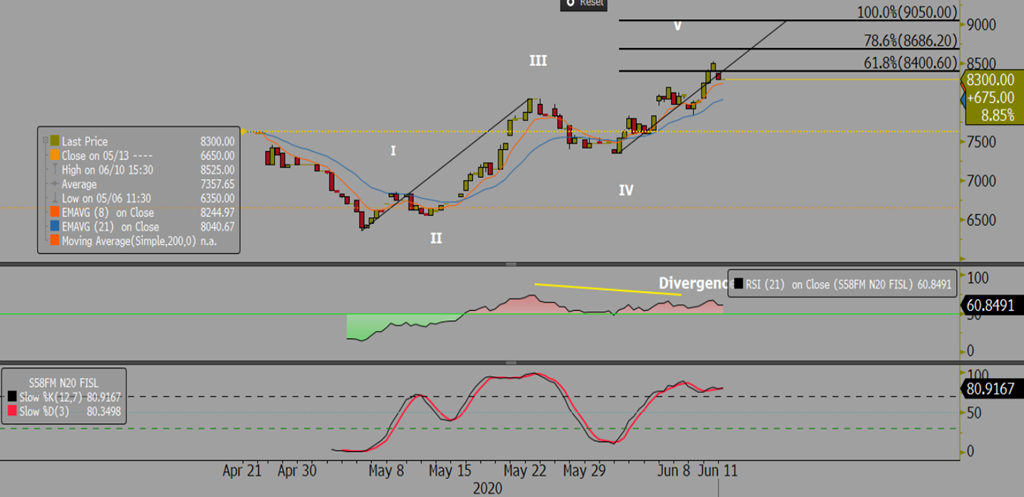

Panamax July 20 Morning Technical Comment – 240 Min

Oil Through the Looking Glass 15/6/20

Continuation of the Crude Slump The week losses have extended into the new week as new virus infections hit China, Japan and the United States. This raises concerns of people in the market on the return of normal demand that had previously raised sentiment at the easing of lockdown. In the US the cutting of …

Capesize rates back to $10,000 level

Capesize rates were back to the $10,000 level again, on the back of robust shipping demand in both basins. Thus, the Capesize 5 time charter average rose by $1,534 day-on-day to $10,676 on Thursday, continuing the bullish run since the start of the week. Follow in the bullish run, the Baltic Dry Index (BDI) soared …

FIS Technical – Brent August Daily

FIS Technical – Brent August Daily To view the full report please click on the link

Panamax futures remain buoyant on China soybean purchases

Panamax futures remained buoyant this week as China continued to buy US Soybeans, despite increased political tensions over Hong Kong. The Q4 futures rallied 5.5% on Wednesday as the world’s second largest economy was revealed as purchasing 10 cargoes of soybeans this month from the U.S. alone, according to Bloomberg. China needs beans and remains …

Continue reading “Panamax futures remain buoyant on China soybean purchases”

Capesize rates race ahead on robust shipping demand

Capesize rates continued to race upward with better shipping demand in both basins, supported by the recent iron ore rally. The Capesize 5 time charter average surged up by another $1,087 day-on-day to $9,142 on Wednesday, marking a rise throughout the week. Likewise, the Baltic Dry Index (BDI) continued to hike and reached 764 points …

Continue reading “Capesize rates race ahead on robust shipping demand”