Category archives: Products

Fuel Oil Daily Evening Report

FIS Capesize Technical Report

Steel margins—King of the Hill

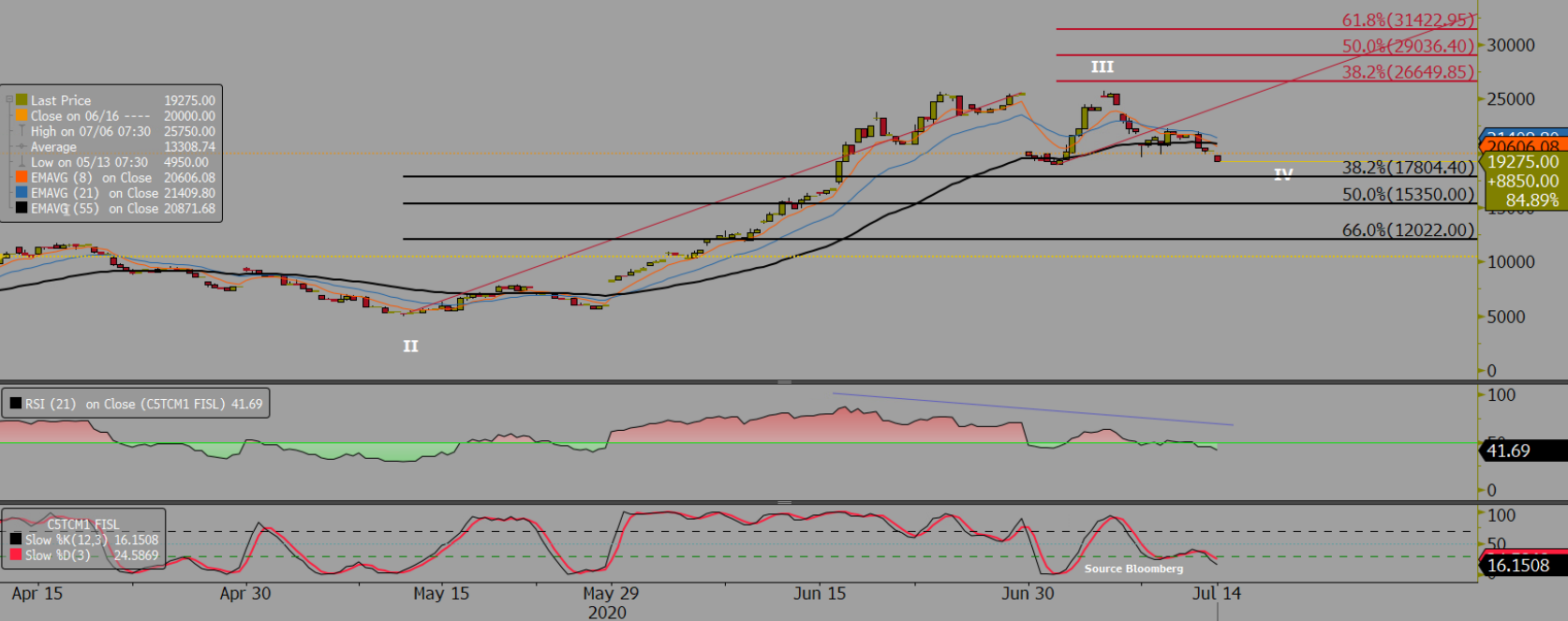

Iron ore futures have been – and remain – an enigma in the commodity markets since the start of the COVID-19 pandemic. The widow-maker is the title of one article on Bloomberg and this is hard to argue; the rhetoric has been about the correction that is coming, not the bull market we have been …

Iron ore futures firmer as Australian volumes surge

Iron ore futures advanced on Tuesday on renewed optimism over a swift economic recovery in China and hopes for further demand after the rainy season. The world’s biggest steel producer brought in 101.68 million tonnes of iron ore last month, surging from 87.03 million tonnes in May, data from the General Administration of Customs …

Continue reading “Iron ore futures firmer as Australian volumes surge”

*Oil Through the Looking Glass 14/7/20*

*US Shale Production to Hit Two Year Low* Shale oil production in the United States looks set to fall to 7.49 million bpd, a drop of 56,000 in a forecast published by the EIA. The U.S. oil and natural gas rig count fell by five to an all-time low of 258 in the week to …

Freight Intraday Morning Technical

FIS Weekly Ferrous: iron ore neutral but risk remains

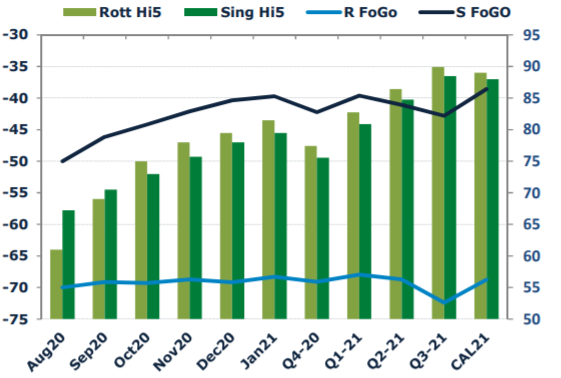

Ferrous Sector Money-flow: The previous weekly report gave seven weeks of short-run consolidation from the end of May when seeing the open interest peak for DCE market. However market was strong by the first half of July. Open interest indicated most of the push was due to exit of shorts and re-entry as new …

Continue reading “FIS Weekly Ferrous: iron ore neutral but risk remains”

Capesize rates slip on thin physical activity

Capesize rates slipped again over market concerns on the deteriorating physical market with long tonnage list in the Pacific market. On that note, the Capesize 5 time charter average dipped by $680 day-on-day to $26,964 on Monday, as the paper market came under pressure on declining physical market. Following the decline, the Baltic Dry Index …

Continue reading “Capesize rates slip on thin physical activity”

DCE rises again on supply concerns

Iron ore futures rose for the second consecutive day on Tuesday, in view of supply tightness in the market. At the closing of the afternoon session, the most-traded iron ore for September delivery on China’s Dalian Commodity Exchange went up by 2.44 % or RMB 20 day-on-day to RMB 838.50 a tonne. Likewise, the steel …