Category archives: Products

Oil Through the Looking Glass 11/6/20

Unexpected Build? The EIA confirmed a large build in US crude stocks at 5.7 mil bbls to put stocks at 538.1 million bbls, a historic record excluding US strategic reserves. This was caused largely by the shipments from Saudi Arabia from the price war pumping in March and April. We knew from the effects on …

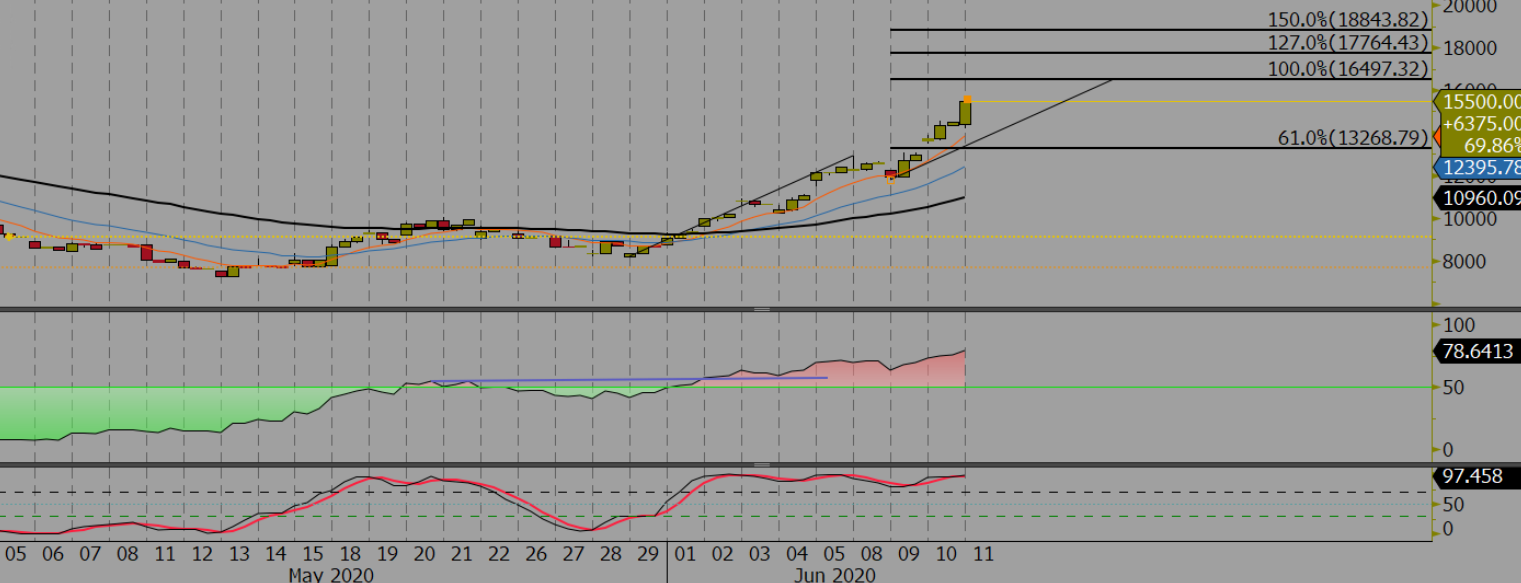

Panamax July 20 Morning Technical Comment – 240 Min

Brent August 20 Morning Technical Comment – 240 Min

FIS Daily Physical Review Jun 11th

Iron Ore and Steel Market Updates MySteel sintered iron ore inventory at 16.62 million tonnes. Sintered iron ore daily consumption 625,100 tonnes. Inventory turnover in 23 days. China weather forecast indicated heavy rain and flood warning in western, mid-China and southern provinces. Guangzhou inventories decrease slower w-o-w, since several floods happen in late May and …

FIS Supramax Technical Report

FIS Supramax Technical Report To view the full report please click on the link

Iron ore softer as pundits exchange views on supply outlook

Iron ore futures were a touch softer on Wednesday as investors assessed the supply outlook for iron ore following the recent closure of Vale’s Itabria complex. Investors grew concerned over tight supply after Vale was ordered to shut down Itabria, which accounts for over 10% of Vale’s output, in the state of Minas Gerais …

Continue reading “Iron ore softer as pundits exchange views on supply outlook”

Oil Through the Looking Glass 10/6/20

The Glut is Back Those of you who have been watching your crude ticker this morning will see many red numbers on the screen. The reason for this has been the switch of sentiment to concerns about oversupply. We have had reports late last night that the API have predicted a large build in US …

Capesize pushes ahead with iron ore rally

Capesize rates continued to push forward with firm iron ore demand that pushed for more shipping activities in the Pacific market. Thus, the Capesize 5 time charter average hiked up by another $310 day-on-day to $8,055 on Tuesday, for the second consecutive day-rise for the week. Following the rally, the Baltic Dry Index (BDI) broke …

Continue reading “Capesize pushes ahead with iron ore rally”