Chinese futures started the week on bullish note, amid market supply concerns and better economic data from China. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, hiked up by 3.22% day-on-day to RMB 752.50 per tonne on Monday. Following the rally, the steel rebar contract on the Shanghai …

Category archives: Products

Oil tries again to accentuate the positives

Brent crude was unchanged at $37.84 a barrel, in the first day of trading in the contract with August as the front month. WTI crude futures for July delivery were at $35.53 a barrel, up 4 cents, or 0.1%, by 0629 GMT. OPEC+ is set to discuss a short extension of its current output cuts, …

Continue reading “Oil tries again to accentuate the positives”

Iron Ore Offshore July 20 Morning Technical Comment – 240 Min Chart

https://freightinvestorservices.com/wp-content/uploads/2020/06/FIS-MorningTechnical-Iron-Ore-Offshore-01-06-20.pdf

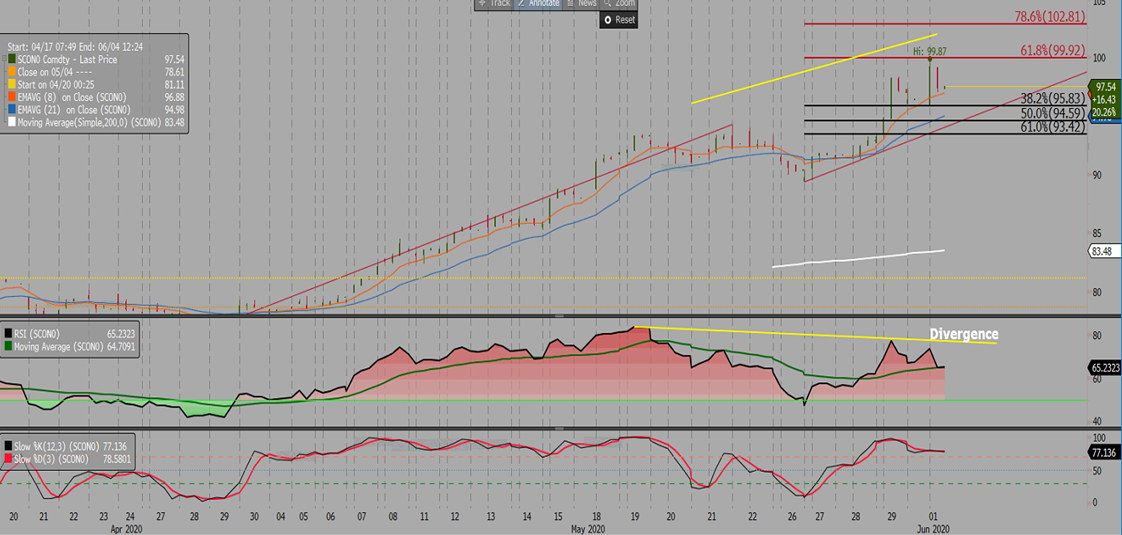

Iron Ore DCE September Daily Technical Review Jun 1st(Hourly Chart from Apr 16th to Jun 1st)

Verdict – Short-term reversal on high level. DCE iron ore pushed up and loss all gains by last two hours. From hourly chart, slow stochastic KD created dead cross in overbought area. CCI created divergence with candles during the second hour of Asian morning. It is worth noting that 100,000 lots of long positions built …

Copper Rallies After Trump Remarks, China Data

Copper in Shanghai headed for its best close since March in a relief rally after U.S.-China tensions eased and manufacturing data from the Asian nation pointed to a continuing slow recovery. President Donald Trump’s threatened new measures against China proved weaker than expected, easing a major source of market jitters over the past week. That left …

Continue reading “Copper Rallies After Trump Remarks, China Data”

Soybeans Climb as Dollar Drops and Trump Keeps Trade Deal Intact

Soybean futures in Chicago advanced as the dollar extended declines and President Donald Trump stopped short of spelling out tough new sanctions against China over Hong Kong and kept the phase one trade deal with Beijing intact. Corn increased, while wheat snapped two days of gains. The Bloomberg Dollar Spot Index tumbled to the weakest in …

Continue reading “Soybeans Climb as Dollar Drops and Trump Keeps Trade Deal Intact”

Iron Ore Seen Gripping On to Surge Before Eventual Descent

Iron ore’s surge, with its latest jump to three-digits, is set to persist in the short term powered by supply concerns, before a market surplus in the second half spells a decline for the steelmaking material. Physical spot ore surged to $101.05 a ton on Friday, the highest since August, according to Mysteel Global. Elevated steel …

Continue reading “Iron Ore Seen Gripping On to Surge Before Eventual Descent”

China’s speedy recovery boosts PMIs in May

When China sneeze, the world catches cold, as the saying goes. However, if China economy recovers, how will the global market react? Once again, there were signs of recovery for the country’s economic after it was heavily embattled by the coronavirus pandemic earlier this year. In May, both the official and private Purchasing Manufacturing Index …

Continue reading “China’s speedy recovery boosts PMIs in May”

FIS Daily Physical Review Jun 1st

Iron Ore and Steel Market Updates – Tangshan brought out new air pollution restriction in June, will potentially affect 35,000 tonnes of pig iron production, equal to 12% lower on blast furnace utilisation rate in Tangshan. – Steelbank Inventory: rebar inventories 7.49 million tonnes, down 4.24% w-o-w. HRC 2.21 million tonnes, down 6.93% w-o-w. – …

FIS Panamax Technical Report

FIS Panamax Technical Report Technically bearish the index has not broken support having produced a 3 wave pattern down. Upside move above the USD 6,093 level would suggest the technical picture is potentially turning bullish To view the full report please click on the link