A total of 2.302 million mt of iron ores was traded for the week ended Sep 18, up 13.40% as compared to the 2.03 million mt recorded last week.

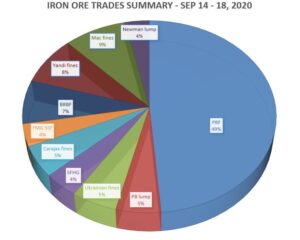

Pilbara Blend fines (PBF) had once again accounted almost half of the transacted trades for this week at 49% of the market share, which was similar level last week.

Then, this was later followed by low grade fines like Mac fines at 8.69% of the market share, and then Yandi fines at 8.25% for the week ended at Sep 18.

Restocking ahead for upcoming holidays

Iron ore prices were on the decline after the high opening at start of the week, reaching at the $130/mt level, before moving down toward the lows $120/mt levels.

Medium grade fines became the firm favorites among Chinese mills due to cost efficiency of using combination of low and high grade ores had narrowed against that of using medium grade fines.

Some trade participants also expect further correction in medium grade fines with more shipping arrivals as well as easing of the port congestion among Chinese ports.

Moving forward, market optimism persisted as Chinese mills normally stocked up for iron ore ahead of the weeklong National Day holidays at October 1-7.

High hopes for Q4 outlook

China’s steel demand is expected to remain robust over the last quarter of the year, due to market expectations of more government stimulus measures to spur the economy.

The country’s automobile sales are also estimated to rise in September and October, due to tax cuts on new vehicle sales.

Hence, most market participants are hopeful that the vehicles sales growth may rise for the sixth straight month into September and subsequently into October as well.