A total of 830,000 mt of iron ores was traded for the week ended Dec 18, almost thrice of the trade volume recorded last week at 180,000 mt.

Iron ore prices continued the rally seen last week with price touching near the $160/mt mark, which resulted some buyers to procure from cheaper portside stocks instead.

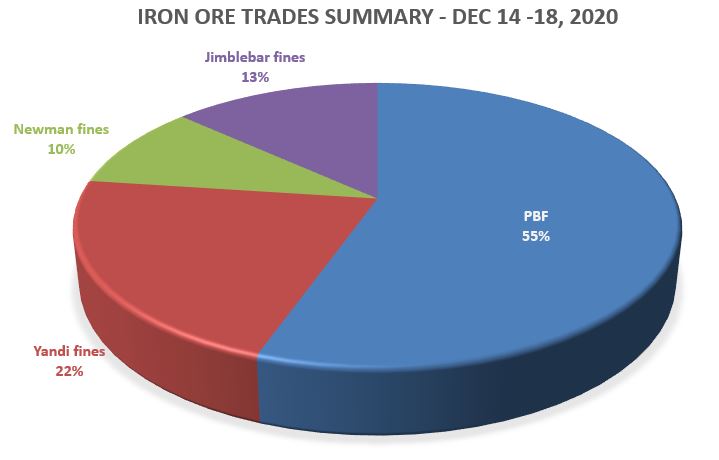

PBF remained the top choice for most buyers, accounted over half of the transacted iron ore products for the week at 55%, then followed by Yandi fines at 22%, then Jimblebar fines at 13% and finally Newman fines at 10%.

Growing interests for low grade ores

Due to the high prices for medium grade fines, some trade participants began to seek for cheaper low-grade fines such as Indian fines at portside.

Most of these buyers were believed to be smaller mills with flexible blast furnace mix, which allowed them to switch to the low-high ores combination to reduce production costs.

Meanwhile, the larger mills continued to favor medium grade fines despite the higher prices. However, some sellers were heard to consider lower premiums and widen discounts for medium grade fines to make them more competitive in the market.

Pellet on the rise

Further price upticks for iron ore pellet were expected, due to limited availability in the spot market. As most of the Indian producers prefer to sell pellets domestically for better prices, rather than offering them at the international market.

Thus, the high pellet prices caused more Chinese mills to use iron ore lump instead which were cheaper. However, lump usage was heard to be utilized at such high rate in the blast furnaces, which caused some mills to switch to using pellets instead.

Meanwhile, the supply tightness of iron ore pellet is expected to ease as Brazil’s Vale pledged to restart Samarco mining operation in late December, after a hiatus of five years due to the dam collapse incident.

Previously, the Samarco complex had iron ore pellet production capacity of 30.5 million per year and its last pellet production reached around 24.9 million mt in 2015.