We know for certain Trump is ‘not happy’, as he announced this to the world this week, when referencing Beijing’s move to impose national security legislation on Hong Kong.

Trump has announced he will announce new U.S. policies on China today; this is making global markets jittery, something the world does not need right now.

The issue to watch is whether the Phase One deal about to crack and if so – are things about to get volatile? If you do, then expect the SEC to knock on the door – nobody can predict the unpredictable.

Hedge funds will tell you that volatility is good for the market, it creates trading opportunities, it is how they make money.

In fact, funds like trends, whether bull or bear, just want something that is stable, predictable and profitable.

If volatility exposure in established markets with a real physical underlying has for centuries been used as a barometer for the global economy (it also happens to produce spectacular trends), is what you are looking for then our markets provide some interesting jumping in points.

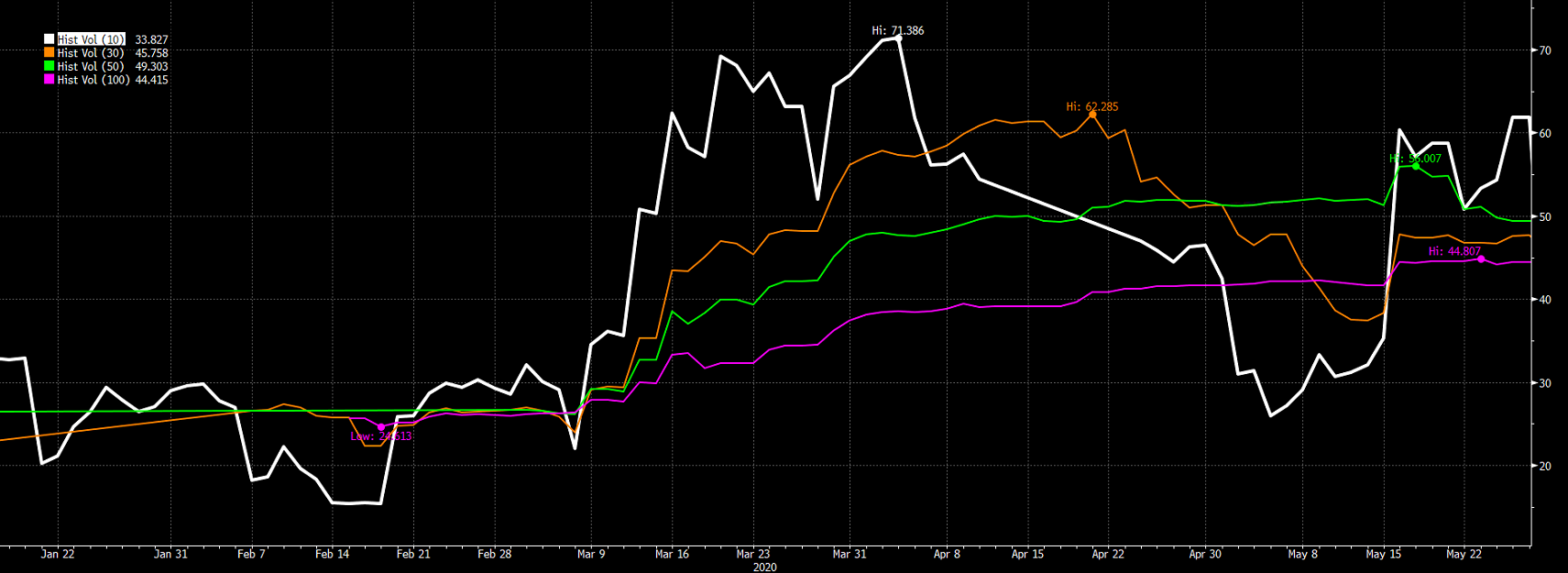

When seeking volatility, it is always best to look at the Capesize futures for a reference. The Q4 10-day historical volatility is currently at 34%, down from 71% on the 2nd of April, but up from 25% on the 12th of May.

Sounds messy, I know, but don’t stop reading, this is the best part. Here are two trends: one lasting 22 days that sold off 20.68%, followed by a seven-day upward move of 21.37%. Did we mention that this stopped at a Fibonacci retracement on the way down (61.8%) and at a 78.6% on the way up (the square root of .618?)

The freight market is technical (for the TA geeks out there, that was Gartley) but this not crypto. This market is driven by a physical underlying, is fundamental, technical and loves to trend.

In other words, it’s a Hedge Fund’s dream!

(FIS)