A total of 770,000 mt of iron ores was traded for the week ended Dec 24, less 7.23% on-week as compared to the trade volume of 770,000 mt recorded last week.

Benchmark iron ore prices peaked above $175/mt since the start of the week, but soon dropped as Dalian Commodity Exchange (DCE) imposed stricter measures to curb speculative trading.

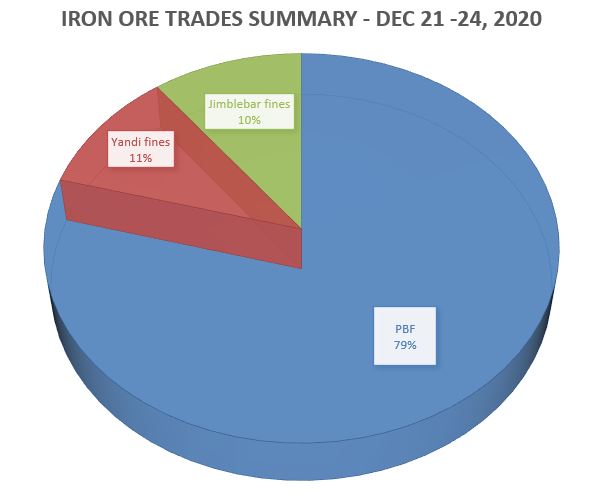

PBF then continued to dominate the traded volume just like last week, as it accounted over two-third of the transacted iron ore products for the week at 79%, then followed by Yandi fines at 11%, and finally Jimblebar fines at 10%.

Record high construction steel prices

Besides the record-high iron ore prices, steel rebar and billet prices also peaked in the week, with Chinese rebar price reached a two-year high RMB 4,493/mt, while Tangshan billet prices rose to RMB 4,020/mt.

According to Mysteel, the construction steel sales had picked at the start of the week, as Chinese end-users replenished inventories.

Despite the rally, there was some market concerns about the slow construction activities in northern China, due to the cold, early winter season.

During the week, most Chinese mills continued to seek for mainstream medium fines like the PBF, though low-grade Indian fines garnered some buying interests as well for cost-saving purposes.

Supply concerns over Brazilian supply

The price upticks for iron ore may derive from market concerns over disruption in Brazilian high grade ore supply, due to the rainy season and the recent landslide incident near Brumadinho.

This landslide was known to have little impact on supply, as the mine complex was already closed for maintenance at that time of incident.

Meanwhile, Vale and BHP had restarted mining operation in Samarco, after meeting the licensing requirements to restart operations.

The mining complex was closed for five years, after a fatal dam collapse in 2015, and the restart will produce around 8 million tonnes of iron ore pellet per annum.