Verdict:

• Short-run Neutral to Bearish.

Macro:

• The FOMC indicated an unchanged interest rate at 5.25%- 5.5%, fell into previous expectation. The US Federal believed the interest cut is inappropriate before the inflation rate reached the target area.

• The manufacturing PMI reached 49.2%, up 0.2% on the month, indicating a recovery of manufacturing industry.

• Brazil central bank cut lending rate by 50bps to 11.25%, estimated another 50bps cut in the next few meetings.

Iron Ore Key Indicators:

• Platts62 $131.80, -3.00, Jan Avg $135.13. Iron ore seaborne trade became quiet when China came into pre-holiday mode. The recovery of marginal steel margin didn’t help comprehensive gaining of steel mills when the utilisation was approaching year-low level.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 31st)

• Futures 106,023,000 tons(Decrease 22,848,300 tons)

• Options 85,333,000 tons(Decrease 25,988,400 tons)

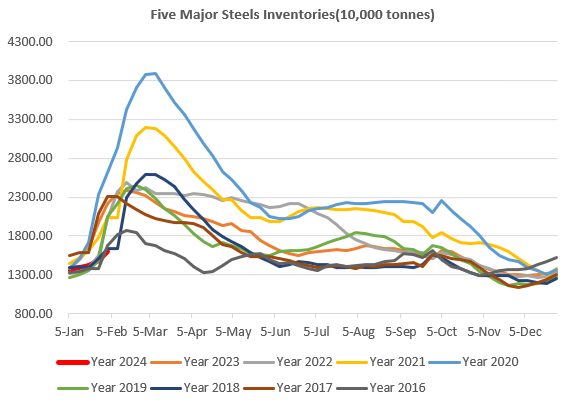

Steel Key Indicators:

• China Tangshan billet average cost at 3820 yuan/ton, down 34 yuan/ton on the week. The average steel production loss at 250 yuan/ton.

Coal Indicators:

• China 110 cokery plants sample utilisation rate at 69.61%, up 1.01% on the week. Daily production of coking coal at 587,500 tons, up 4,100 tons on the week.

• The seaborne Australia FOB market maintained quiet when the wide difference between buyers and sellers, however there were March cargoes of PMV available on the market.