Market Verdict on Iron Ore:

• Neutral.

Macro:

• China “Two Sessions” political conference would open soon. The market was focusing on the government report, including economy target, investment confidence, market risk, jobs.

• ECB economist believed that the Eurozone inflation risk started to ease, however the EBC would not end the rate hike until the inflation fell below 2%. Thus, there is possibility to see 50 bps hike in March.

Iron Ore Key Indicators:

• Platts62 $124.10, +1.60, MTD $125.75. The seaborne market maintain muted this week, after the physical trader clearing March cargoes, PBF March premium and April premium both slumped. April dropped from $1.25 to $0.4, which finally obtained some interests. The market in general feel the April float price was low and confident on the resilence of April demand.

• Qinghuangdao government decided to remove the air pollution alert from 6p.m. February 18th. Tangshan government removed air pollution alert from March 1st. Market expect the production cut would come to an end in northern China provinces.

• Discount levels basis of the IODEX for Super Special Fines (SSF) and Fortescue Blend Fines (FBF) narrowed to 9.25% and 6% respectively in March from 12.5% and 7.5% in February. The discount for Western Pilbara Fines (WPF) also narrowed to 2% for March from 2.25%.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 28th)

• Futures 94,355,000 tons(Decrease 22,893,200 tons)

• Options 73,400,100 tons(Decrease 16,984,500 tons)

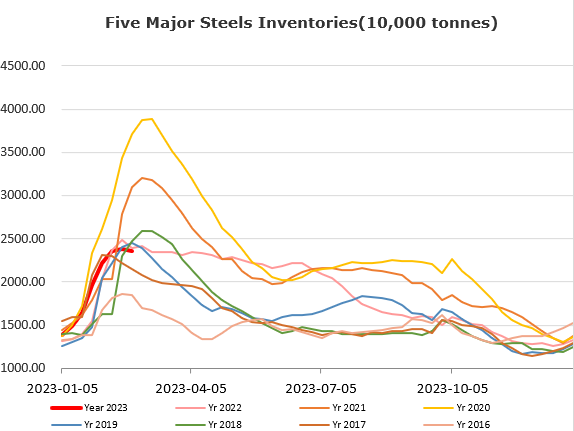

Steel Key Indicators:

• China NBS published total crude steel production at 1.018 billion tons, down 1.7% on the year. Steel products produced 1.34 billion tons, up 0.3% on the year.

Coal Indicators:

• The FOB Australia coking coal market started to collapse after supply recovered significantly, with current highest trade seen was PMV Goonyella April laycan reported done at $347.