Verdict:

• Short-run Neutral.

Macro:

• According to China National Bureau of Statistics, China produced 1.019 billion tons of crude steels in 2023, unchanged from 2022. China produced 1.36 billion tons of finished steels, up 5.2% on the year. China produced 4.71 billion tons of coals, up 3.0% on the year.

• One of the most important inflation rate indicator, US PCE up by 0.4% in January, refreshed the biggest single month of past year, supported the cautious interest cut expectations by policy makers.

Iron Ore Key Indicators:

• Platts62 $117.10, +0.20, MTD $124.86. Iron ore market ticked up yesterday with the increasing production on steels of China yesterday. However traders were waiting for the confirm of stable increase. Mills were still cautious buying because of the overall loss, although virtual steel margin was indicating a sign of recovery.

• China 45 ports iron ore inventories at 138.92 million tons, up 2.89 million tons on the week. Daily evacuation 2.93 million tons, up 234,200 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 29th)

• Futures 116,322,100 tons(Increase 561,600 tons)

• Options 127,471,800 tons(Increase 1,710,000 tons)

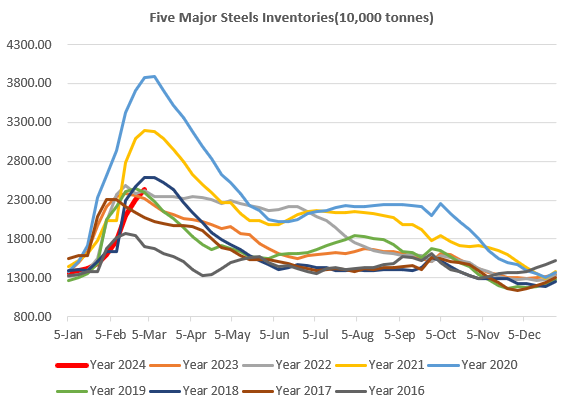

Steel Key Indicators:

• MySteel surveyed 247 blast furnace operation rate at 75.19%, down 0.44% on the week, down 5.88% on the year. Utilisation rate at 83.34%, down 0.25% on the week, down 3.81% on the year.

Coal Indicators:

• The 16 China ports coking coal inventories at 5.91 million tons, up 451,200 tons on the week.