Market Verdict on Iron Ore:

• According to CME FedWatch, the probability to maintain interest rate unchanged at September reached 82%, while the probability to hike 25% reached 18%. The probability to maintain unchanged interest rate for November reached 68%.

Macro:

• European Central Bank President Christine Lagarde stated that interest rate hikes may be raised or suspended in September. Lagarde said that inflation must return to the target level and interest strategies should became restrictive at a certain level and for a period of time.

• China July manufacturing PMI 49.3, est. 49.2, last 49.

Iron Ore Key Indicators:

• Platts62 $110.05, +0.65, Jul Avg $112.46. Seaborne iron ore market was quiet on last Friday and Monday. The current stable steel margin provided support for high and mid grade concentrates. However, in long run, the restriction plan cut off pig iron demand in H2, which provided resistance to iron ore. There was JMBF traded at $4.4 discount on platform based on September AM Index.

• The Chinese ports arrivals decreased by 2.956 million tons to 20.338 million tons because of the current typhoon weather.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 31st)

• Futures 94,427,700 tons(Decrease 19,098,000 tons)

• Options 84,273,700 tons(Decrease 25,410,100 tons)

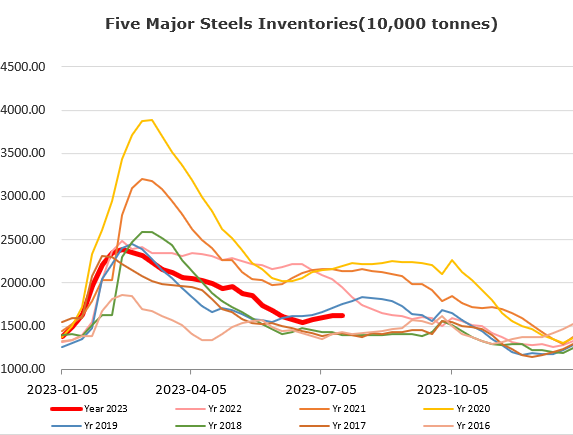

Steel Key Indicators:

• MySteel surveyed six blast furnace of Tangshan restarted normal operation, expected more recovery on other mills next week.

Coal Indicators:

• Northern and western China provinces are proposing for the fourth round of price increase by 100-110 yuan/ton, yet to receive any response from steel mills.