Market Verdict on Iron Ore:

• Neutral.

Macro

• Eurozon August CPI up 9.1% on the year, refreshed historical high, est. 9%, last 8.9%.

• The number of U.S. ADP in August was 132,000, much less than expected 300,000.

Iron Ore Key Indicators:

• Platts62 $100.95, +3.35, AUG AVG $104.76. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium. Chinese northern ports has over 6 million tons of pellets, which hasn’t no change since June. However India mills were anxious about their pellets inventories on hand. The premium was hitting three-year-low, given the high export tax. The unexpected spike in afternoon yesterday was potentially due to a month-end arbitrage on settlement index. Some market participants indicated bottom-fishing activities. The physical trading volume from seaborne boosted yesterday, which was the most active day during past three weeks.

• FMG unexpected narrowed discount on the flagship brands SSF from 14% to 12.5% and FBFfrom 10% to 8.5%, although competitor miner BHP was lowering Yandi Fines through past two months.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 31st)

• Futures 85,656,300 tons(Decrease 18,702,400 tons)

• Options 79,212,600 tons(Decrease23,002,500 tons)

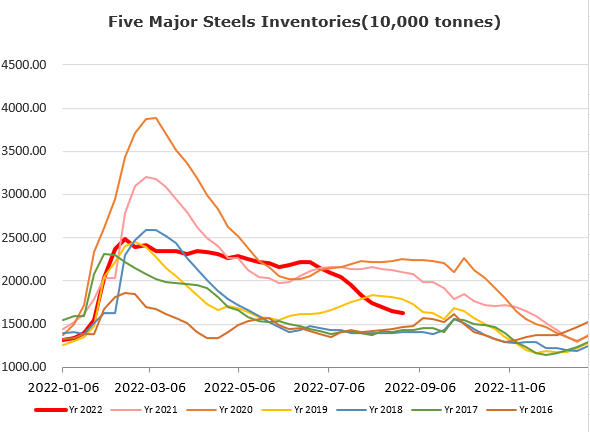

Steel Key Indicators

• 37 Chinese listed steel companies published half-year report. In H1 2022 total realised 1.19 billion yuan, net in come 34.06 billion yuan. 5 out of 37 companies realised net growth, 27 out 37 realised net loss.

Coal Indicators

• Australia met coal saw mixed outlook during the week, since buyers were waiting for new direction. FOB Australia and CFR China PLV index remain flat during the week. India end-users indicated the high coking coal price would stressed their steel margins. China seaborne demand yet to confirm.