Verdict:

• Short-run Neutral.

Macro:

• China held Financial Work Conference, emphasizing to build long-term mechanism to prevent and resolve risks from local debts. In addition it also mentioned providing more fudnes in innovation, high-tech manufacturing, green technology and mid/small cap companies.

• China Manufacturing PMI fell under boom and bust line at 49.5.

Iron Ore Key Indicators:

• Platts62 $123.15, +0.25, Oct Avg $118.91. NHGF saw a $122.2 trade yesterday with early December laycan, there was also above $124 level offer following. NHGF was taken over by PBF for few days. China winter is looming, some inquiries on lumps and pellets emerged.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 31st)

• Futures 115,351,300 tons(Decrease 29,367,400 tons)

• Options 94,742,800 tons(Decrease 31,000,800 tons)

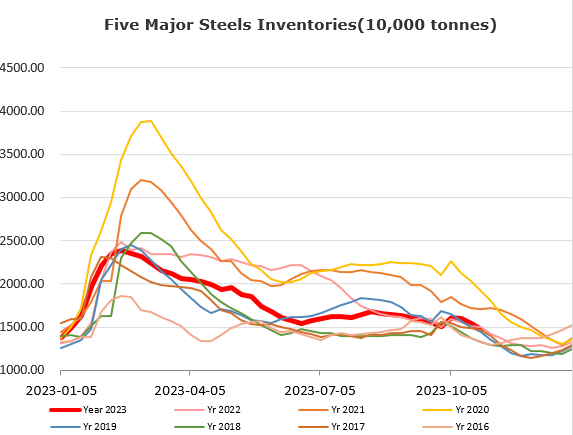

Steel Key Indicators:

• US HRC prices increased after the UAW reached tentative agreements with Auto Companies. Integrated steelmaker Cleveland Cliffs raised HRC price to $900/st, following the price increase from US Steel in late October.

Coal Indicators:

• The FOB Australia market index was stable with an offer at $350 and current bid at $340-345 level. End-users were not urgent to make procurement.

• China steel mills in Hebei province started to propose a 100-110 yuan/ton decrease. Market expected a general landing over China areas for this round of cut.