Market Verdict on Iron Ore:

• Neutral.

Macro:

• Citi Bank expected the global economy growth drop below 2% in 2023, similar to previous predictions by Morgan Stanley, Barkley, Goldman Sachs.

• China November official PMI 48, est. 49, last 49.2.

• U.S. Federal Jerome Powell indicated that potentially slow down December interest hike.

Iron Ore Key Indicators:

• Platts62 $101.15, -0.10, NOV AVG $93.25.Medium grade fines saw significant improving interests, trades volume increased from late last week. BHP sold 80,000mt NHGF at $100.8. The market expect more PBF, MACF and JMBF trade during this week. The front spread dec-jan, jan-feb were considered still at low area given a high base number.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 30th)

• Futures 94,415,000 tons(Decrease 29,387,700 tons)

• Options 74,932,500 tons(Decrease 25,187,100 tons)

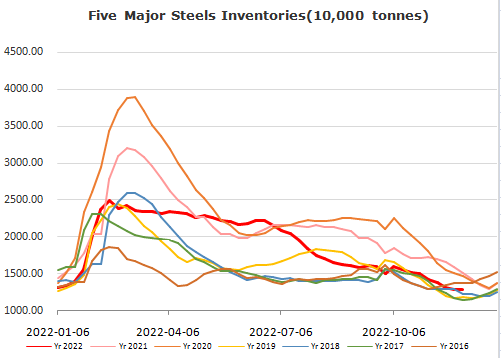

Steel Key Indicators:

• Tangshan average billet cost 3704 yuan/ton ex-factory, up 52 yuan/ton. Steel mills production loss at 154 yuan/ton.

Coal Indicators:

• Australia FOB market consolidated from $245-247 during the current two weeks.Tradable levels were heard in the $240-250/mt FOB Australia for December loading. The index was linked to massive trade at $246.5 for Goonyella PMV at current days. There was offer on January delivery at $252, however enticed no bid.

• Chinese cokery plants were proposing the second round of price uptick.