Verdict:

• Short-run Neutral.

Macro:

• China December Manufacturing PMI 49.0, est. 49.5, last 49.4. Non-Manufacturing PMI 50.4, est. 50.5, last 50.2.

Iron Ore Key Indicators:

• Platts62 $140.50, +1.60, MTD $136.37. Steel mills maintained low inventory levels during past week due to low steel margin. FMG widened the discounts for term contracts across SSF from 6.5% to 6.75%, FBF from 3.5% to 4%. The change on the discounts fell in expectations as an import loss on Chinese ports.

• From December 25th to 31st, the total delivery of iron ore from Brazil and Australia reached 27.57 million tons, down 1.238 million tonnes on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 29th)

• Futures 105,474,200 tons(Decrease 24,589,400 tons)

• Options 76,861,400 tons(Decrease 34,347,300 tons)

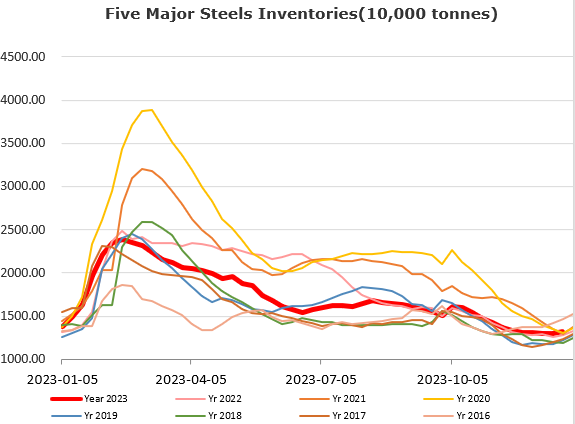

Steel Key Indicators:

• TS billet maintained at 3660 yuan/ton unchanged for the past week and early half of this week.

Coal Indicators:

• After few rounds of price increase, Tangshan mills started to decrease physical coke price by 100- 110 yuan/ton.