Market Verdict on Iron Ore:

• Neutral to bearish.

Macro:

• U.S. non-agriculture employment reached 517,000, created the biggest increase since July 2022, est. 185,000, last 260,000.

• The Institute of Economy, Chinese Academy of Social Science published predictions on GDP growth at 3.4%, 7.2%, 4.2% and 5.2% for the four quarters of 2023 respectively.

Iron Ore Key Indicators:

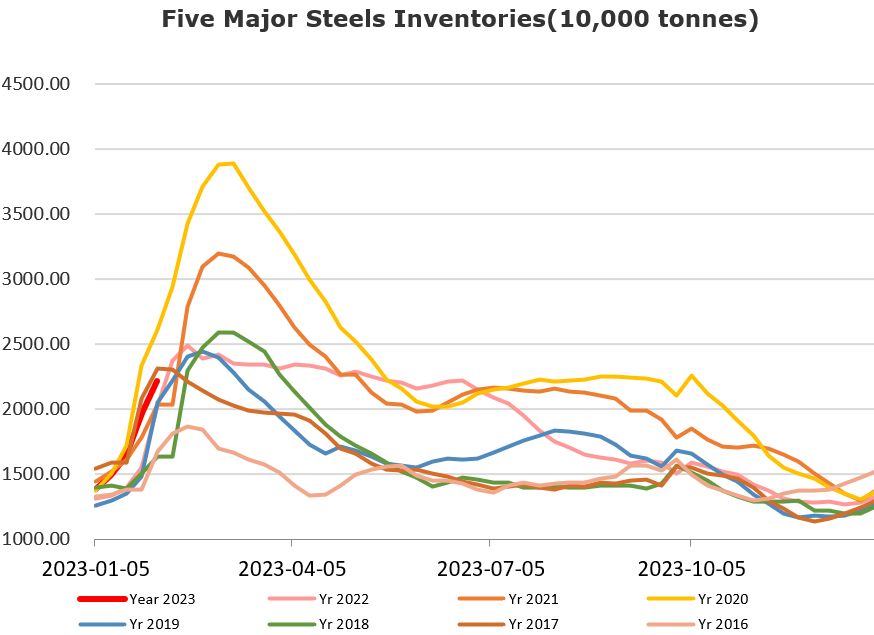

• Platts62 $126.25, +1.10, MTD $126.03. Chinese steel mills iron ore stock level was low, compared with last three years. Thus, restocking expected to increase in the next few weeks. However secondary iron ore sales meet with difficulties given an import loss in Chinese ports. As a result, premiums saw significant pressure.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 3rd)

• Futures 99,981,900 tons(Increase 3,777,500 tons)

• Options 73,139,500 tons(Increase 2,032,800 tons)

Steel Key Indicators:

• MySteel researched 87 independent EAFs average operation rate at 7.66%, up 1.86% on the week.

Coal Indicators:

• There was 30,000mt PLV Peak Downs traded at $350.25/mt, for March laycans. The FOB Australia coking coal market was stable during the past week.