Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• MySteel estimated 45 Chinese iron ore ports total inventories at 127.52 million tons, down 412,900 tons. Daily evacuation at 2.9099 million tons, down 7,200 tons on the week.

• Eurozone May inflation rate decreased from 7% to 6.1%, lower than expected 6.3%. The core consumer price slowed down in May as well.

Iron Ore Key Indicators:

• Platts62 $104.35, +1.15, MTD $104.35. The seaborne trade maintained active on Thursday and Friday. Trafigura bought MACF from Citic Metal at $102.35 CFR Qingdao, while Trafigura also bought NHGF from Cargill at $104.3, both for June laycan. There were two PBF trade based on float price of June and July at $1.05 and $2.8 respectively.

• MySteel estimated 45 Chinese iron ore ports total inventories at 127.52 million tons, down 412,900 tons. Daily evacuation at 2.9099 million tons, down 7,200 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 1st)

• Futures 83,919,900 tons(Increase 2,102,400 tons)

• Options 92,420,100 tons(Increase 737,500 tons)

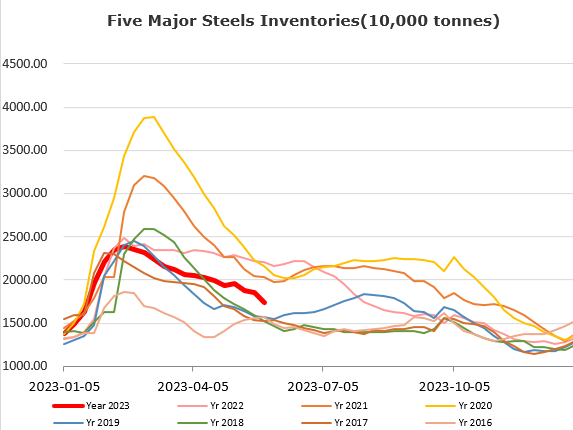

Steel Key Indicators:

• MySteel estimated 247 steel mills utilisation rate at 82.36%, unchanged from last week, down 1.32% on the year. Daily pig iron production at 2.4081 million tons, down 7,100 tons on the week, down 18,100 tons on the year.

Coal Indicators:

• Tangshan physical coke price down 50- 100 yuan/ton, total down 800-900 yuan/ton during the past ten rounds.