Market Verdict on Iron Ore:

• Neutral.

Macro

• China MIIT calculated the scrap input ratio in steelmaking reaching 15%, accounting for 180 million tons in 2025. In 2030, the ratio expected to reach 20%.

• China Caixin Manufacturing PMI in July 50.4, 1.3 lower than June. U.S. Markit Manufacturing PMI 52.2, est. 52.3, last 52.3.

Iron Ore Key Indicators:

• Platts62 $112.90, -1.10, MTD $112.90. The term contract discounts for FMG in August widened in August, however market participants indicated that the current discounts were not great enough to attract buying interest. Mainstream seaborne cargoes including PBF, MACF, NMHG and JMBF were traded actively during the past two weeks. However the secondary market maintained quiet, indicating the demand market was yet to catch up with the fast increasing price on primary market.

• During the week July 25- 31st, China 45 ports arrived in 21.65 million tons of iron ore, up 1.879 million tons w-o-w. Northern six ports arrived in 11.546 million tons, up 2.185 million tons w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 1st)

• Futures 89,391,700 tons(Increase 398,900 tons)

• Options 83,247,500 tons(Increase 1,039,000 tons)

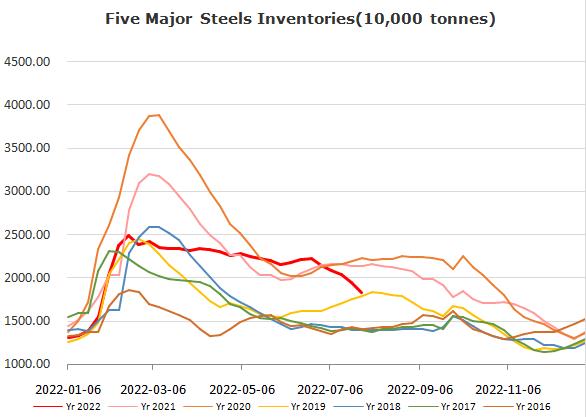

Steel Key Indicators

• China July steel PMI 34.5%, down 2.7%, refreshed new low since March 2020.

Coal Indicators

• China H1 2022 total coal production 2.19 billion tons, up 11% y-o-y.