Macro:

• The China National Development and Reform Commission: select projects with healthy income to encourage the enrollment of private capital, by increasing issuance REITs in infrastructure, promoting qualified private investment projects to issue infrastructure REITs.

Iron Ore Key Indicators:

• Platts62 $109.55, -0.50, MTD $109.55. Seaborne iron ore market was quiet from last Friday to early this week. The current stable steel margin provided support for high and mid grade concentrates. However, in long run, the restriction plan cut off pig iron demand in H2, which provided resistance to iron ore. There was Fe62.3% NHGF traded at $109 on platform yesterday. Vale announced $11 increase on pellet premium for Q3 at $52/dmt. DR premiums up $15/dmt to $60/dmt.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 1st)

• Futures 96,559,400 tons(Increase 2,131,700 tons)

• Options 85,420,700 tons(Increase 1,147,000 tons)

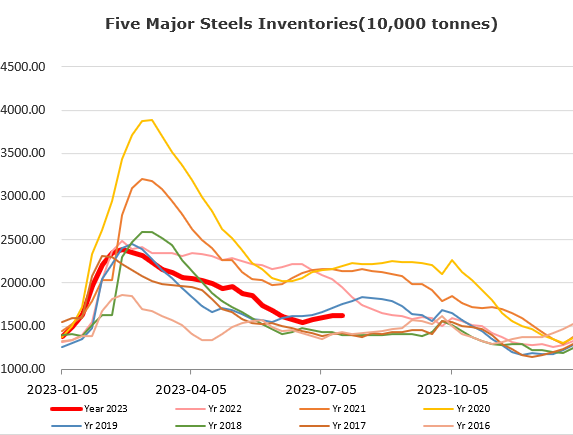

Steel Key Indicators:

• OECD surveyed global steel production reached 2.459 billion tons, up 32.1 million tons or 1.3%. Asia crude steel produced 1.63 billion tons, up 0.5% on the year.

Coal Indicators:

• The FOB Australia Index jumped up $5 yesterday, contributed by a $242 trade on low vol Saraji coking coal, for September laycan.