Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• China Caixin Manufacturing PMI 49.4, up 0.2 compared to October. U.K. Manufacturing November PMI 46.5, better than expected 46.2. Japan Manufacturing PMI 49, last 49.4. EU November Manufacturing PMI 47.1, lower than expected 47.3. Germany November Manufacturing PMI 46.2, last 46.7.

• U.S. Federal Jerome Powell indicated that potentially slow down December interest hike.

Iron Ore Key Indicators:

• Platts62 $103.10, +1.95, MTD $103.10. Import loss emerged again as the quick raise of seaborne iron ore. Chinese northern steel margin also squeezed to negative area. Medium grade fines saw significant improving interests, trades volume increased from late last week. BHP sold 80,000mt NHGF at $100.8. The market expect more PBF, MACF and JMBF trade during this week. The front spread dec-jan, jan-feb were considered still at low area given a high base number.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 2nd)

• Futures 95,915,700 tons(Increase 1,500,700 tons)

• Options 76,022,300 tons(Increase 1,089,800 tons)

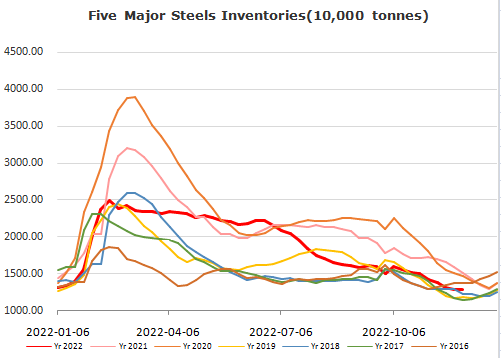

Steel Key Indicators:

• Tangshan average billet cost 3704 yuan/ton ex-factory, up 52 yuan/ton. Steel mills production loss at 154 yuan/ton.

Coal Indicators:

• Australia FOB market consolidated from $245-247 during the current two weeks.Tradable levels were heard in the $240-250/mt FOB Australia for December loading. The index was linked to massive trade at $246.5 for Goonyella PMV at current days. There was offer on January delivery at $252, however enticed no bid.

• Chinese cokery plants were proposing the second round of price uptick.