Market Verdict on Iron Ore:

• Neutral.

Macro:

• The banking crisis does not seem to be over yet, with the latest focus on Credit Suisse Financial Group. Morgan Stanley released a report saying that the outflow rate of funds from customers of Credit Suisse Wealth Management was twice as expected. The target price of the stock for next year will be $68, a 31% decrease from the previous expected value of $99, and the profit forecast for the next two years will be reduced by 30%.

Iron Ore Key Indicators:

• Platts62 $127.30, -0.70, Mar Avg $127.06. FMG narrowed discount price for FBF from 6% to 5.5% in April, rolled over discount for SSF at 9.25%. It is the third consecutive month for FMG to narrow discount. The iron ore market was back to normal as the risk appetite shift back. Physical trades on both float and fixed improved significantly. Rio Tinto sold a fixed price laycan for PBF at $127.3. There was at least 1 laycan of PBF trade per day from last week. BHP sold JMBF at discount of $4.15 over May average. MB65-P62 spread printed 9-month high at $16 supported by the Chinese mills production favored strategies.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 31st)

• Futures 87,036,400 tons(Decrease 22,014,200 tons)

• Options 94,511,800 tons(Decrease 19,804,800 tons)

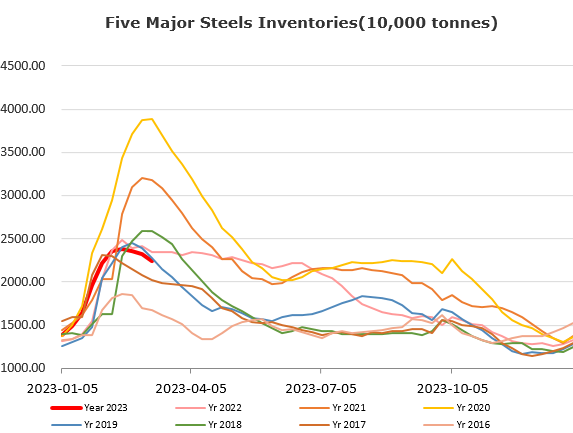

Steel Key Indicators:

• China sample steel mills blast utilisation rate at 90.56%, up 1.28% on the week. Daily pig iron production at 2.4335 million tons, up 35,300 tons on the week.

Coal Indicators:

• Australia FOB market saw active trades and enquires after the big slides on the index price. There were PLVs sold at $330.45 net back on FOB China.