Verdict:

• Short-run Neutral.

Macro:

• US PCE April price index up 0.2%, refreshed new low since December 2023, est. 0.3%, last 0.3%.

• According to Euro Statistics, EU inflation in May reached 2.6%, 0.2% higher than April.

Iron Ore Key Indicators:

• Platts62 $115.25, +0.10, MTD $117.52. There were two SSF sold at Fe58% June Index and discount of 13.88%. SSF maintained its original discount at June supported by strong demand given a sharp drop on physical and futures market last week. WPF widened discounts from 4% to 5.25%. FBF widened discount from 7.25% to 10%. China blast furnace utilisation rate dropped for two weeks, however the absolute number expected to maintain around 2.35 million tons/day in next few weeks, which was 50,000 tons less compared to the same period of 2023.

SGX Iron Ore 62% Futures& Options Open Interest (May 31st)

• Futures 112,585,000 tons(Decrease 26,439,100 tons)

• Options 151,139,700 tons(Decrease 35,111,100 tons)

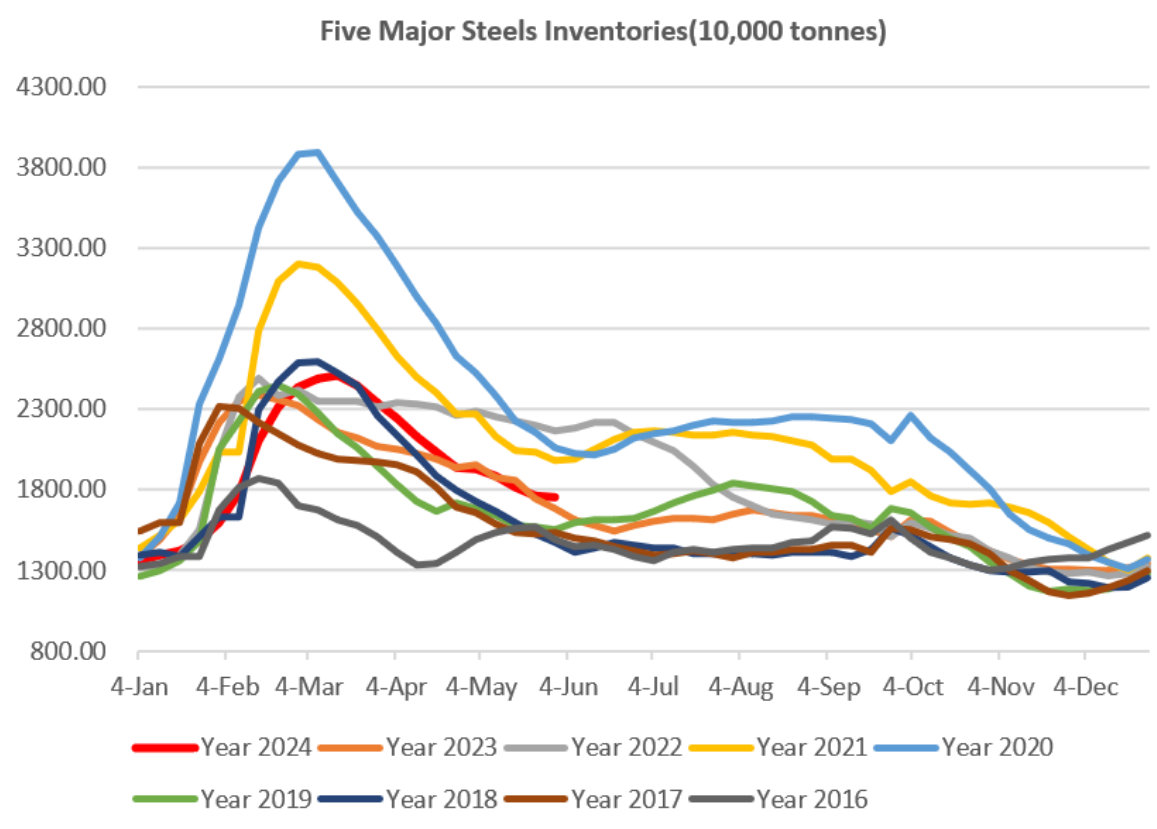

Steel Key Indicators:

• MS researched 247 steel mills at 81.65%, up 0.15% on the week, down 0.71% on the year.

Coal Indicators:

• Indian election in recent weeks postponed some demand of coking coal market from June to July.