Market Verdict on Iron Ore:

• Neutral to bearish.

Macro:

• The U.S. PCE index in May up 4.6% on the year, est. 4.7%, last 4.7%. The index up 0.3% on the month, est. 0.3%, last 0.4%.

Iron Ore Key Indicators:

• Platts62 $111.60, -1.90, Jun Avg $112.57. The rumors on Tangshan restriction consistently creating the supply decrease expectation on the market. However seaborne margin was driven back to zero after seeing positive margin numbers. The high grade, for example, IOCJ’s demand is coming back because of the gradual expensive mid-grade fines.

• According to the official website of the China Qian’an Municipal Government, on July 1st, 2023, a material leakage accident occurred at Shougang Malanzhuang Iron Mine Co., Ltd., causing three people to lose contact. The accident is currently under emergency rescue.

• China Central Committee and the State Council urged to accelerate the development and construction of domestic iron ore projects, and improve the iron ore resources to guarantee capacity, the Industry Department of the National Development and Reform Commission organised a research forum on accelerating the development and construction of domestic key iron ore projects in Anshan City, Liaoning Province, on June 8th.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 30th)

• Futures 88,464,700 tons(Decrease 24,386,000 tons)

• Options 86,734,600 tons(Decrease 32,509,500 tons)

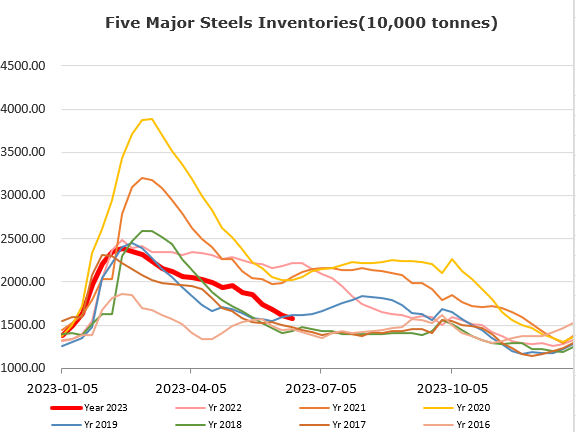

Steel Key Indicators:

• Turkey scrap maintained stable mode as less bids and offers showing in the open market. The tradeable value was ranged from $370 – 372/mt, after a major mill procured at $370.mt.

Coal Indicators:

• There was 30,000mt Peak Downs PLV delivered in August traded at $234 late last week. However, Indian end users were considering alternative second Tier sources from U.S., Canada, Poland, or Ukraine.