Verdict:

• Short-run Neutral to Bullish.

Macro:

• The United Nations conference on trade and development predicted that the global GDP growth will be around 3% in 2024, the short-term trade outlook is cautiously optimistic. Global trade volume may reach 32 $trillion in 2024, however lower than record high at 2022.

• US Federal Chair Jerome Powell said the latest economic data suggest inflation returned to a downward trend, but need more evidence before further interest cut.

Iron Ore Key Indicators:

• Platts62 $110.55, +0.50, MTD $110.30. The market sentiment warmed during the past two trading days, as increasing price on both futures and physical market. The trade on physical market became active again, seeing trade on NHGF, BRBF and JMBF. The laycans were concentrated in August.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 2nd)

• Futures 104,616,000 tons(Increase 355,700 tons)

• Options 146,081,600 tons(Increase 1,451,000 tons)

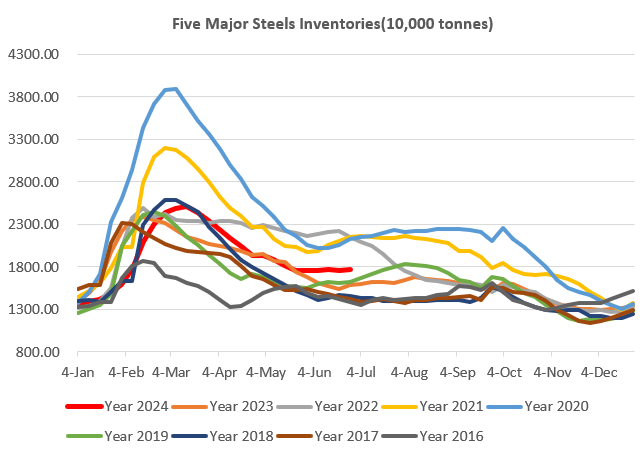

Steel Key Indicators:

• China 76 independent EAFs average loss at 207 yuan/ton, average cost at 3805 yuan/ton.

Coal Indicators:

• The market continued speculation on the fire impact from Grosvenor mine of Anglo-Amercian. The FOB Australia coking coal index up $12.8/mt on the day, and up by $11.2 on previous day. However, China CFR coking price maintain unchanged during the same time.