Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. Federal pushed back against a narrative that policy makers are envisioning a pivot away from tightening. Four Federal distinct-bank presidents highlighted in remarks on Tuesday that there was no sign yet of inflation easing.

• China July Machinery Index 96.55, down 12.18% on the year, down 5.49% on the month.

Iron Ore Key Indicators:

• Platts62 $113.30, +0.40, MTD $113.10. The term contract discounts for FMG in August widened in August, however market participants indicated that the current discounts were not great enough to attract buying interest. Mainstream seaborne cargoes including PBF, MACF, NMHG and JMBF were traded actively during the past two weeks. However the secondary market maintained quiet, indicating the demand market was yet to catch up with the fast increasing price on primary market.

• During the week July 25- 31st, China 45 ports arrived in 21.65 million tons of iron ore, up 1.879 million tons w-o-w. Northern six ports arrived in 11.546 million tons, up 2.185 million tons w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 2nd)

• Futures 89,994,300 tons(Increase 602,600 tons)

• Options 83,800,000 tons(Increase 552,500 tons)

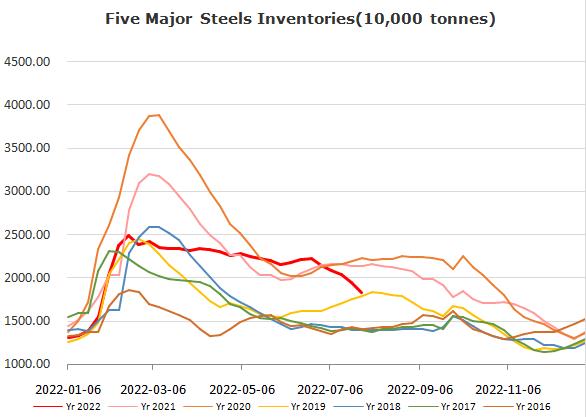

Steel Key Indicators

• Some cities in Hebei province started new round of production curb from August 1-6th, without mentioning the details of impact.

Coal Indicators

• North western province Ningxia started the second round of coke price increase by 100 yuan/ton, total up 200 yuan/ton over the last two rounds.