Verdict:

Neutral to Bearish

Macro:

• China CISA proposes cancelling night trading of iron ore, rebar, coking coal and related nine ferrous products.

• U.S. ADP in July new jobs increased by 324,000, est. 190,000, last 497,000.

Iron Ore Key Indicators:

• Platts62 $109.55, -0.50, MTD $109.55. The seaborne trade was light this week. However Fe60.5% JMBF discount narrowed from $4.4 to $3.95. The steel margin recovery potentially support the resilient demand of iron ore in seaborne market.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 2nd)

• Futures 98,280,000 tons(Increase 1,720,600 tons)

• Options 88,764,200 tons(Increase 3,343,500 tons)

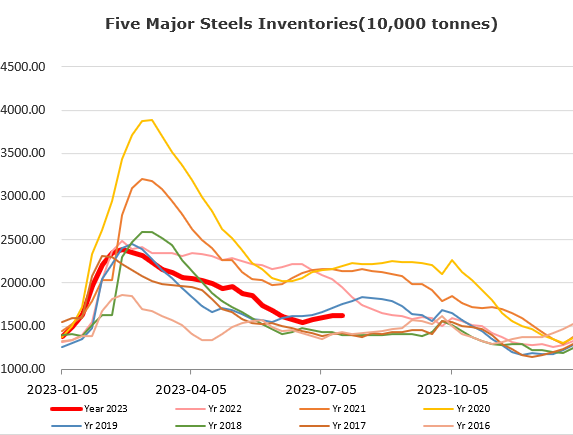

Steel Key Indicators:

• Tangshan average billet cost 3532 yuan/ton, up 21 yuan/ton, average profit at 88 yuan/ton.

Coal Indicators:

• The FOB Australia Index jumped up $9 in the past two trading days, contributed by a $242 trade on low vol Saraji coking coal for September laycan and a following HCCA trade at $246.