Verdict:

• Short-run Neutral.

Macro:

• China Caixin manufacturing PMI reached 50.4 in August, up 0.6 from July.

• Reuters: Saudi Arab expected to decrease most of oils sold to Asia in October after a drop on Dubai oil.

Iron Ore Key Indicators:

• Platts62 $96.15, -4.10, MTD $96.15. The supply of MACFs were ample for September, however the demand for the products were strongly supported for the high cost-effectiveness.

• China 45 ports iron ore arrivals at 22.09 milllion tons, down 3.577 million tons. Six northern ports iron ore arrivals at 11.346 million tons, down 1.19 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 2nd)

• Futures 128,126,600 tons(Increase 3,003,600 tons)

• Options 144,696,600 tons(Increase 300,500 tons)

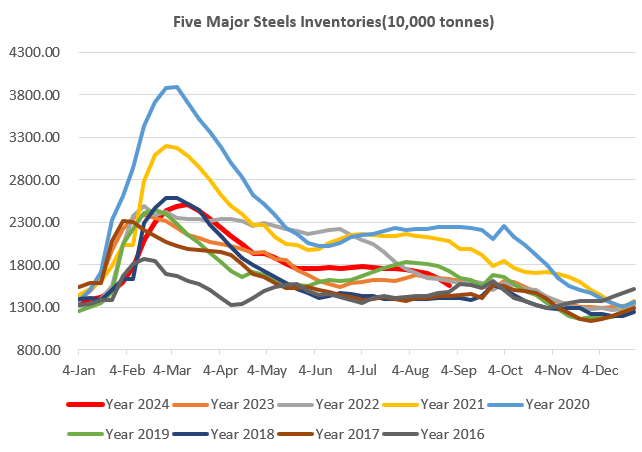

Steel Key Indicators:

• China EAFs average cost at 3340 yuan/ton, average loss at 77 yuan/ton.

Coking Coal and Coke Indicators:

• FOB Australia Coking Coal market stablised although eyeing the sharp drop on China futures market. The market participants were waiting for further direction on China physical market. Some traders indicated that the Q4 supply on prime coals were limited, which could support price level in long-run.