Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• U.S. FOMC increased interest rate by 75 bps to 3.75%-4%, as expected. However Jerome Powell speech mentioned the Federal potentially increase the target interest rate to 5%. U.S. stock index correct massively after the speech.

• ECB president Christine Lagarde said that the main task of Europe at present is to stabilize prices, and all feasible means must be used to achieve this goal. Even if the possibility of economic recession in the euro area increases, the European Central Bank must continue to raise interest rates to fight inflation.

• Yi Gang, governor of the Chinese central bank, said at the “International Financial Leaders Investment Summit” of the Hong Kong Monetary Authority that the potential growth rate of China’s economy will remain within a reasonable range. The Chinese yuan exchange rate will remain stable. There has been marginal improvement in real estate sales and loan issuance. Yi believed that the real estate market can maintain stable and healthy development.

Iron Ore Key Indicators:

• Platts62 $83.05, +2.90, MTD $81.60. Iron ore corrected massively last week, because of the sharp drop on steel margin and expected lower pig iron demand in the month ahead. NMHG was sold at $81.2, BRBF was sold at $82.2. The correction has already attracted bottom fishing traders. Thus, fixed-cargoes liquidity remain healthy.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 2nd)

• Futures 92,861,400 tons(Increase 2,365,000 tons)

• Options 81,116,800 tons(Increase 127,500 tons)

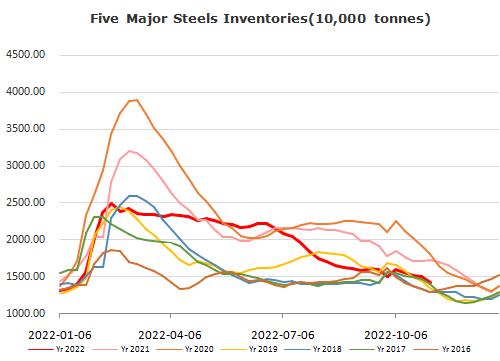

Steel Key Indicators:

• China October steel PMI down 12% on the month.

Coal Indicators:

• FOB Australia coking coal surprisingly up 4.5$ to $311.5 last Friday, although during the huge correction in ferrous complex globally. The market participants indicated that the PLV above $300 was supported by the lack of supplies. China buying interests for U.S. low volatility coking coal ranged from $270- 330. U.S. suppliers wouldn’t consider the opportunities at lower range given the high freight cost.