Verdict:

• Short-run Neutral to Bearish.

Macro:

• The minutes of the Federal Reserve meeting showed the interest rate hike cycle that began in 2022 potentially have ended, and the federal funds rate should peaked. Interest cuts are expected to come before the end of 2024.

Iron Ore Key Indicators:

• Platts62 $143.95, +0.75, MTD $143.58. The low grade iron ore saw limited upside room, due to the high price level last for last two quarters and low steel margin. The FMG derailment should be a minimal impact as the operation had resumed. There was NHGF traded at fixed price at $143/mt yesterday and JMBF traded at $2.8 discount based on February average index.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 3rd)

• Futures 108,311,600 tons(Increase 1,842,000 tons)

• Options 80,078,400 tons(Increase 1,820,000 tons)

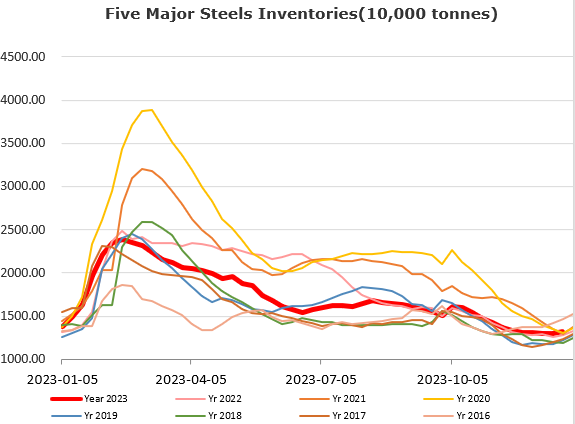

Steel Key Indicators:

• Tangshan average billet cost 3960 yuan/ton, up 26 yuan/ton on the week, average production loss at 260 yuan/ton.

Coal Indicators:

• Red Sea confliction resulted some delay on seaborne coking coals.

• Market participants started to worry about the incoming rainy weather in Australia.